Investment Thesis

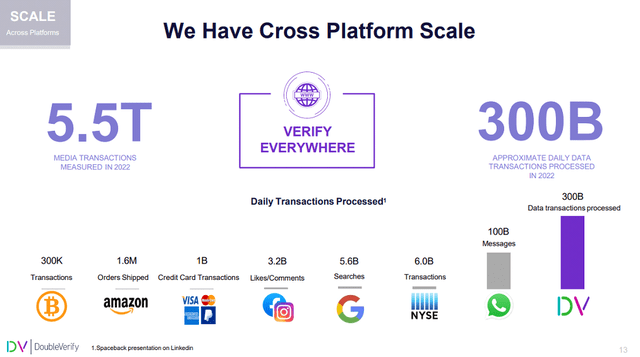

DoubleVerify Holdings, Inc. (NYSE:DV) has established itself as a leader in measuring ad effectiveness and applying analytics across various platforms, including desktop, mobile apps, connected TVs, and social platforms. Its comprehensive reach has made it a recognized standard for evaluating the authenticity and impact of advertisements across different channels. The company benefits from a stable revenue stream, primarily consisting of well-known brands. Its integration into customers’ purchasing processes and the incorporation of its metrics make it difficult for competitors to displace or replace DoubleVerify. The network effect, which requires accreditation and a critical mass of brands and advertisers, poses a significant barrier to new market entrants.

Company Overview

Founded in 2008, DoubleVerify is a leading platform for digital ad measurement and analytics. Its technology enables customers to increase the effectiveness of their digital ad spending by measuring whether a digital ad is displayed in a fraud-free, brand-safe environment is viewable, and is seen in the intended geography. DoubleVerify’s Pinnacle platform is integrated across the digital advertising ecosystem and delivers analytics across all key digital media channels. DoubleVerify’s headquarters is in New York City. The company serves >1,000 customers across a variety of verticals, which include >50 of the top 100 global advertisers, such as Colgate-Palmolive, Ford, Mondelēz, and Pfizer. Its large programmatic advertising partners include Google and The Trade Desk.

Q1 2023 Review: Strong Performance and Outlook

DoubleVerify reported better-than-expected Q1 results, driven by strong growth in Measurement revenue, although Activation and Supply-side revenues decelerated. The company raised its guidance for FY23, with a possibility of gradual revenue reacceleration in the second half of the year as year-over-year comparisons ease. While organic revenue growth is expected to slow from pre-slowdown levels, I remain positive about DoubleVerify’s consistent execution and guidance framework. The company’s decision to raise its guidance for FY23 by a greater margin than the Q1 beat further reinforced management’s positive near-term outlook. Despite some pressure on gross margins and ongoing investments, DoubleVerify exceeded expectations with its adjusted EBITDA margin, surpassing guidance by 100 basis points. Overall, I remain positive about the company’s prospects, and the company’s performance in the previous quarter adds to my optimism.

Product Breadth & Network Effect

DoubleVerify has established itself as a leading provider of ad measurement and analytics, covering various platforms such as desktop, mobile apps, connected TVs, and social platforms. Since its inception in 2008 and the introduction of its brand safety solution in 2010, the company has developed internal capabilities, including pre-bid targeting, viewability assessment, and fraud detection. It has also formed partnerships with programmatic ad providers like The Trade Desk (TTD). DoubleVerify’s credibility is bolstered by accreditations from reputable industry organizations such as the Media Rating Council (MRC) in the US, the German Association for the Digital Economy (BVDW), and Centre d’Étude des Supports de Publicité in France, among others.

Moreover, I believe that capturing significant market share will be challenging for new entrants, which solidifies DoubleVerify’s position in the market. Independent third-party verification is crucial in the industry, and relying on measurement tools provided by Google (GOOG) and Facebook (META), which own their platforms, may not be considered unbiased. To be taken seriously, industry accreditations are required. Moreover, a network effect acts as a barrier, as it is difficult to engage with brands (advertisers) without working with publishers, yet engaging with publishers becomes challenging without brand support.

Company Presentation

Valuation

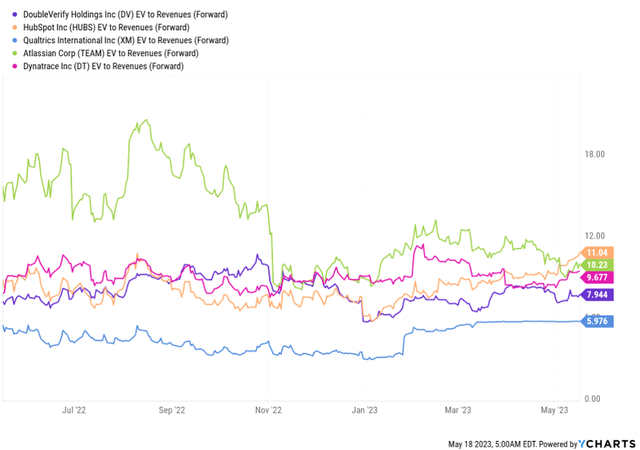

I examine a group of comparable companies to inform my view of DoubleVerify’s valuation and rating. DoubleVerify is already profitable, although I don’t think it will trade on earnings at this stage of its growth curve, so I look at EV/revenue multiples with a focus on the calendar year 2023. DoubleVerify is currently trading at 7.9x EV/CY23E revenue, trading at a discount to the average multiple of the Digital Marketing Advertising + Customer engagement comps (HUBS, SPT, XM, and ZEN). My Dec 2023 price target of $35 is based on 8x EV/CY23E revenue, which represents a discount to its historical multiple.

Ycharts.com

Risks to Price Target

DoubleVerify operates in a nascent and constantly evolving market. This dynamic presents a number of risks to both the upside and downside. The competitive landscape presents an opportunity as there are few capable large vendors, but competition could intensify as penetration deepens. Additionally, new media types present an opportunity for top-line growth, but it could also mandate significant investment into R&D to develop products for these new media.

Conclusion

DoubleVerify is a leading provider of ad measurement and analytics, offering comprehensive solutions across various platforms. DoubleVerify is well-positioned in an advantageous competitive landscape, with only a couple of major competitors in the expanding ad verification market. The company has developed internal capabilities and formed partnerships with programmatic ad providers. It has earned accreditations from reputable industry organizations, enhancing its credibility. I believe there is significant potential for sustained growth in the market, and DoubleVerify is the company best positioned to capitalize on this opportunity. Hence, I view the stock as a long-term buy.

Read the full article here