Summary

ChargePoint $8.63 (New York symbol NYSE:CHPT; Electric Utilities; Shares outstanding: 350.5 million; Market cap: $3.0 billion; www.chargepoint.com) provides hardware and software for electric vehicle (“EV”) charging stations. The company was founded in 2007 and was listed in February 2021 via a business combination with a special purpose acquisition company, or SPAC.

There is much to like about ChargePoint – the company operates in a fast-growing market strongly supported by government policies and fiscal incentives. In addition, the company is managed by an experienced team and has a large share of the slow-charging electric vehicle market in the U.S.

However, financial losses have accumulated rapidly over the past few years, and the balance sheet will soon need further reinforcement. In addition, competition in the U.S. market will be intense over the next few years as a range of additional suppliers will enter or expand their offerings. The best that investors in CHPT stock can hope for is a take-over bid by a deep-pocketed manufacturing, energy or utility company that wants to grow their presence in the EV charging market.

The business remains highly unprofitable, but sales are ramping up

ChargePoint designs and provides hardware and software to electric vehicle charging stations in the U.S., Canada, and Europe. The current portfolio consists of approximately 225,000 outlets covering commercial operators (such as retail malls, offices, and airports), fleet operators (delivery vehicles, ridesharing), and private homes and apartments. The charging portfolio consists mostly of slow-charging alternating current ports with a small portion of fast-charging direct current ports.

ChargePoint supplies the charging hardware, connected with cloud-based software that allows commercial and fleet operators to manage charging at their facilities. The company does not generally own or operate the charging stations and does not sell electricity. The hardware and software are sold as a package with the networking software and ongoing parts and labor warranties sold under subscription models.

Products are designed in-house but are manufactured by contract manufacturers in the U.S., Mexico, and Europe.

The company generated strong revenue growth over the past 3 years. In the most-recent fiscal year that ended January 2023, revenues amounted to $468 million – 3.3 times higher than the revenues generated in 2020.

Revenues are mostly derived from the sale of charging system infrastructure with the balance of the revenues coming from subscriptions to cloud-based networking services as well as maintenance plans.

ChargePoint makes use of contract manufacturers to produce its charging systems. The cost to produce the charging systems moved up strongly in 2023 amounting to 68% of revenues. Management ascribes the large jump in production costs to the higher number of units delivered and to higher production and logistics costs caused by component shortages and supply chain challenges.

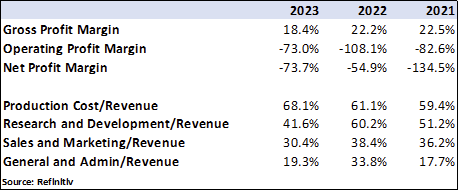

The much higher production costs depressed the gross profit margin to 18.4% compared to 22.2% and 22.5% in the preceding two years (see table). This was a disappointing outcome as the expectation was for the gross margin to improve as revenues ramp up.

Research and development expenses amounted to 42% of revenues in 2023, while sales and marketing expenses were another large item with $142 million spent on salaries, sales commissions, and travel. General and administrative expenses amounted to $90 million, or 19% of revenues. These expense ratios improved compared to the previous year resulting in an improved, albeit still highly negative, operating profit margin.

Refinitiv

Interest expenses jumped to $9.4 million for the year as the interest cost of the 2027 convertible notes kicked in. This contributed to depressing the net profit margin in 2023.

Enthusiastic growth expectations

The International Energy Agency (“IEA”) estimates that electric car (“EV”) sales increased globally by 60% to 10 million in 2022, representing 14% of all cars sold during the year. China continued to lead with sales of 6 million EVs in the year. Meanwhile, Europe and the US lagged, with sales of 2.7 million and 800,000 EVs, respectively.

Spending on EVs was up by 50% in 2022, amounting to $425 billion while governments added another $40 billion through direct incentives. The China-based company BYD (OTCPK:BYDDY) held an 18% share of the global EV market in 2022, followed by Tesla (TSLA) (13%), Geely/Volvo (OTCPK:GELYF) (6%), and General Motors (GM) (6%).

The Agency also reported that the sale of electric light commercial vehicles worldwide increased by more than 90% in 2022 while 66,000 electric buses and 60,000 medium-and heavy-duty trucks were sold globally.

The IEA predicts that 2023 will see a 35% jump in EV sales to 14 million vehicles for the year representing 18% of the global total. In the U.S., the expectation is for another bumper year, with electric car sales reaching 1.5 million, bringing the EV sales share up to 12%. Europe is expected to have slower growth in 2023 with sales growing by 25%, with a quarter of cars sold in Europe being electric.

The long-term forecast from the IEA indicates further significant growth for electrical vehicles in the coming decades. Under a conservative scenario, the EV fleet (including passenger cars and, light commercial vehicles and trucks but excluding two/three-wheelers) grows from 30 million to 240 million by 2030 or 30% per year. Total EV sales reach 20 million in 2025 and 40 million in 2030, representing 20% and 30% of all vehicle sales, respectively. Other scenarios indicate higher growth for the EV fleet but all point to significant growth ahead.

In the U.S., the current administration has set a target of EV sales amounting to 50% of all vehicle sales by 2030, up from less than 5% in 2021. Various policy measures including stricter fuel economy standards, financial incentives for EV production as well as charging infrastructure development are expected to accelerate the adoption of EVs in the U.S. from the current low base.

Automakers are also gearing up to deliver significant increases in EVs over the next decade. General Motors is planning to have a one million EV production capacity by 2025, Volkswagen (OTCPK:VWAGY) targets to be fully electric by 2033, and Toyota (TM) plans to deliver 1.5 million EV sales and 10 additional models by 2026, while BMW (OTCPK:BMWYY) plans to sell over 2 million EVs by 2025 and Honda (HMC) plans to launch 30 EV models producing 2 million EVs by 2030.

While much of EV charging for private cars takes place at homes, a further acceleration in EV growth will require an improvement and expansion of the public charging infrastructure, especially in the U.S. and Canada.

At the end of 2022, there were 2.7 million public charging points worldwide, about 55% more than the previous year. Most of the chargers were installed in China (1.75 million), followed by Europe (570,000), and the U.S. and Canada (160,000).

Under the various scenarios sketched by the IEA, the public charging capacity will have to expand drastically with the total number of slow and fast chargers growing to 13 million by 2030 with most of the capacity being added in Europe and the U.S.

In the U.S. the current administration aims to build a network of 500,000 public EV chargers not more than 80km apart on the major highways. A total amount of $7.5 billion has been earmarked to build charging stations.

Competition everywhere

Competition in the space is severe as the prize to dominate is large. The competition can be split into various categories including hardware and software providers and charge point owners, although many providers have products and services that fall into more than one category.

Significant U.S. competitors include Tesla, Blink (BLNK), EVgo (EVGO), Electrify America, Shell (SHEL), Hertz (HTZ) and BP. In Europe, the company faces competition from providers such as Wallbox (WBX), Allego (ALLG), Shell Recharge, Total Energy (OTCPK:TOTZF), BP, Siemens (OTCPK:SIEGY), ABB (ABB), and Schneider Electric (OTCPK:SBGSF).

According to data provided by the U.S. Department of Energy, ChargePoint has a market share of 37% of all publicly available charging point connectors in the U.S. and Canada followed by Tesla with a 20% share. In the fast-charging direct current market, Tesla dominates with 60% of all charging ports compared to 6% operated by ChargePoint.

As the demand for EVs in North America develops further, the competition to supply of networked chargers will intensify. Tesla intends to open a portion of its U.S. Supercharger and Destination Charger network making 7,500 chargers available for all EVs by the end of 2024. Hertz and BP intend to build a national fast-charging network across the U.S., with BP committing to invest $1 billion in EV charging in the U.S. by 2030. Pilot Company, General Motors, and EVgo have partnered to deliver 2,000 fast-chargers along the U.S. highways, while Electrify America, Mercedes-Benz, and Ford are among other companies investing in charging infrastructure.

ChargePoint also operates in Europe where competition is already intense. The company operates in 16 countries having started operations in 2017. Balance sheet was supported by capital raised during the year.

The company had shareholders equity of $355 million by the end of January 2023, and total long-term debt of $295 million. Cash and short-term investments amounted to $269 million after the company issued $300 million of 5-year convertible notes at a yield of 3.5% during the year. The company also issued common stock raising $50 million during the year.

Cash flow from operations amounted to -$267 million for the fiscal year while capital expenditures were light at $19 million.

Over the past 4 quarters, the company experienced a negative operating cash flow of an average of $67 million per quarter. And there was also $5 million of capital expenditure per quarter. This implies that at the current rate of operating losses, the company has enough cash to sustain the business for a little more than 12 months.

The capital raising options have also become less attractive as interest rates moved up while the depressed stock price makes equity issues expensive. We note that the company has a shelf registration and ATM facility filed with the SEC for the issue of an additional $1 billion of common stock, preferred stock, debt securities, or warrants. At the end of January 2023, $450 million of shares of common stock was available under this facility.

Corporate governance

Mr. Bruce Chizen (age 67) is the Chair of the board of directors. He was the CEO of Adobe between 2000-2007 and is also a board member of Informatica, Synopsis, and Oracle.

Mr. Pasquale Romano (age 57) is the President and Chief Executive Officer. He has served in these roles since February 2011. Previously he was a co-founder of 2Wire, Inc., a provider of broadband service delivery platforms; this business was later acquired by Pace Plc. In 1989, he co-founded Fluent, Inc., a digital video networking company; the company was sold to Novell Corporation in 1993. He holds degrees from Harvard University and Massachusetts Institute of Technology.

At the end of January 2023, the top shareholders were Linse Capital (9.5% of issued shares), Q-GRG Investment Partners (9.9%), Vanguard (6.9%), Blackrock, and the CPP Investment Board. These entities jointly owned about 28% of the issued capital. Linse and Quantum are private equity firms, based in Puerto Rico and Texas, respectively. We note that Linse was an active seller of ChargePoint shares in April 2023, with total sales amounting to about 1.5% of the shares of the company. The directors and executive officers together hold 12.9% of the share capital of the company.

The annual compensation of the executive officers consists of three components: a base salary; an annual cash bonus, and long-term incentives in the form of equity awards. The annual cash bonus is linked to the achievement of revenue and EBITDA growth targets.

The CEO received a total compensation of $16.8 million in the 2023 fiscal year of which the cash component was less than 10%. Mr. Romano holds 2.0% of the issued shares.

An uncertain valuation

ChargePoint has made losses in each of the past 6 years and the losses have also been growing – note that the 2023 loss was the largest since the listing and more than double the loss recorded in 2022.

Prospects for profits in the near or even medium term are also not promising. As per the company’s pronouncements: “ChargePoint believes it will continue to incur significant operating expenses and net losses in future quarters for the near term. There can be no assurance that it will be able to achieve or maintain profitability in the future.”

Analysts that follow the company estimate on average that the losses will continue in 2024 and 2025 with a small profit expected in 2026. Based on 2026 estimates the stock trades on an EV/EBITDA multiple of 32 times and a price/earnings ratio of 46 times. However, we would treat this as subject to large potential errors as the estimates are highly speculative.

A speculative investment

It is a challenge to construct a credible scenario where investors will make a decent return on an investment in ChargePoint, given the considerable and mostly unquantifiable risks. To hope for a takeover bid from a deep-pocketed entity wishing to gain access to the U.S. EV charger market is equally speculative.

By Deon Vernooy, CFA, for TSI Wealth Network

Read the full article here