In September of 2017, I received slightly over $100K from my former employer, representing the commuted value of my pension plan. I decided to invest 100% of this money in dividend growth stocks.

Each month, I publish my results on those investments. I don’t do this to brag. I do this to show my readers that it is possible to build a lasting portfolio during all market conditions. Some months we might appear to underperform, but you must trust the process over the long term to evaluate our performance more accurately.

Performance in Review

Let’s start with the numbers as of May 8th, 2023 (before the bell):

Original amount invested in September 2017 (no additional capital added): $108,760.02.

- Portfolio value: $217,654.60

- Dividends paid: $4,733.06 (TTM)

- Average yield: 2.17%

- 2022 performance: -12.08%

- SPY= -18.17%, XIU.TO = -6.36%

- Dividend growth: +10.83%

Total return since inception (Sep 2017-April 2023): 100.12%

Annualized return (since September 2017 – 68 months): 13.02%

SPDR® S&P 500 ETF Trust (SPY) annualized return (since Sept 2017): 83.98% (total return 11.36%)

iShares S&P/TSX 60 ETF (XIU:CA) annualized return (since Sept 2017): 65.34% (total return 9.28%)

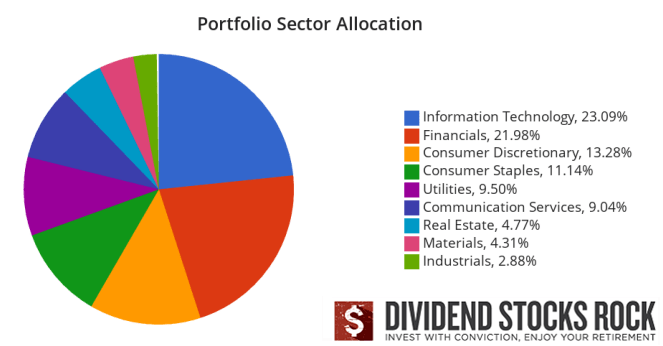

Dynamic sector allocation calculated by DSR PRO as of April 6th.

Sometimes, Investing Isn’t Exciting (But it Works)

Over the past three years, we went through a boatload of emotion, and the stock market followed the waves! Most recently, I did a spring cleaning in my portfolio and sold positions I no longer believed in. This is a crucial step for investors: making sure you hold the right stocks for your strategy. I was thrilled by my new purchases, notably CCL Industries (CCLB.C:CA)(OTCPK:CCLLF) and Home Depot (HD), and I can’t wait to see how they do over the next 10 years.

But each month and each quarter doesn’t necessarily bring a comparable level of excitement. This month, I did what we all should do monthly: I counted my dividends, I reallocated some liquidity to buy 5 more shares of Royal Bank (RY:CA) (RY), and I added a position to my Smith Manoeuvre portfolio. I did the boring housekeeping we should do, and I didn’t get excited.

Don’t forget we are in this game for the long haul. We are not running a 100m sprint as we are in for the longest ultra-marathon ever created. The good news is that we are in a passive ultra-marathon. The only thing that must be done most of the time is simply waiting and trusting your strategy.

When I look back at the creation of my portfolio in 2017, I still hold many of my positions 6 years later:

I added Alimentation Couche-Tard (ATD:CA) (OTCPK:ANCUF, OTCPK:ANCTF), Royal Bank, Disney (DIS), Microsoft (MSFT), Starbucks (SBUX), and Texas Instruments (TXN) to my portfolio on the first month I started to invest the value of my pension plan. By the beginning of 2018, I had completed my portfolio and added shares of Magna International (MG:CA)(MGA), Fortis (FTS:CA)(FTS), Apple (AAPL).

That’s roughly half of my portfolio that has not changed since the creation of this account. Interestingly, most of those stocks show impressive results, as many are in the triple-digit return club.

This is how I doubled the value of my pension plan without adding a dollar of new capital over the past 5.5 years:

I stayed invested and let “boring & consistency” be the guiding strategy for my portfolio.

No fluff, no crazy swing trades, and no options. I did my due diligence and ensured that most of my portfolio followed my investment strategy focused on dividend growth.

The best thing to do with your portfolio is often not to do anything. That’s what I did last month, and this is what I will do for most of 2023.

I still have more cleaning to do as CAE (CAE:CA) (CAE) and Disney have not paid a dividend since Covid. Disney has already announced its intention to reinstate the dividend payment by the end of this year. We have silent radio coming from CAE. I will hold on to those two companies until the end of the year before making a final decision.

Smith Manoeuvre Update

The SM strategy is back! When you attempt any kind of leveraged strategy, you must be certain to follow these rules:

#1 Have a long-term horizon (minimum 10 years) to benefit from a full stock market cycle.

#2 Be comfortable with market fluctuations (your portfolio could go down 20% as it’s part of the game).

#3 Be comfortable financially (have an emergency fund + the ability to pay off the debt without liquidating the assets).

I followed my rules and took a break after spending too much time creating lifetime memories with my family in Africa. I’m now back with a new $500 per month since March 1st.

So far, the Smith Manoeuvre strategy has worked well as the portfolio shows a total return of more than 7% while I paid less than 6% in interest (which is tax deductible). My current interest rate is 6.72% but I don’t expect it to stay that high for long. In the meantime, I’m buying great companies at good prices, and I can handle the interest rate at this time.

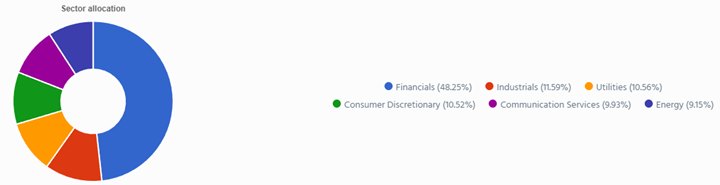

The portfolio is slowly taking shape with 8 companies spread across 6 sectors. My goal is to build a portfolio generating 4-5% in yield across 15 positions. I will continue to add a new stock monthly until I reach that goal. My current yield is at 4.52%.

Adding 3 shares of Canadian Tire

It’s difficult to build a portfolio with a high yield that will continue offering capital and dividend growth. I added Canadian Tire (CTC.A:CA) to my portfolio for diversification (adding a new sector) and for relatively low valuation (P/E ratio below 10, dividend discount model showing a small bargain on the current price). The company demonstrated the resilience of its business model during the pandemic and past recessions. With a low payout ratio, I’m confident it will be a great dividend grower for this portfolio.

Here’s my SM portfolio as of May 8th, 2023 (before the bell):

| Company Name | Ticker | Sector | Market Value |

| Brookfield Infrastructure | BIPC:CA | Utilities | $521.46 |

| Canadian National Resources | CNQ:CA | Energy | $462.54 |

| Canadian Tire | CTA.A:CA | Consumer Disc. | 523.95 |

| Exchange Income | EIF:CA | Industrials | $577.28 |

| Great-West Lifeco | GWO:CA | Financials | $655.01 |

| National Bank | NA:CA | Financials | $609.36 |

| Telus | T:CA | Communications | $506.34 |

| TD Bank* | TD:CA | Financials | $1,166.20 |

| Cash (Margin) | -$631.05 | ||

| Total | $4,391.09 | ||

| Amount borrowed | -$4,000.00 |

I also have a larger position in TD (23% of my portfolio) as I continue to trade on margin on this one. On top of the $500 I invest monthly, I borrowed another ~$500 to double my position. I think the fear around Canadian banks is exaggerated and I intend to benefit from Mr. Market’s current panic.

Let’s look at my CDN portfolio. Numbers are as of May 8th, 2023 (before the bell):

Canadian Portfolio (CAD)

| Company Name | Ticker | Sector | Market Value |

| Alimentation Couche-Tard | ATD:CA | Cons. Staples | $24,128.39 |

| Brookfield Renewable | BEPC:CA | Utilities | $10,591.62 |

| CAE | CAE:CA | Industrials | $5,910.00 |

| CCL Industries | CCL.B:CA | Materials | $8,967.00 |

| Fortis | FTS:CA | Utilities | $10,403.64 |

| Granite REIT | GRT.UN:CA | Real Estate | $10,460.16 |

| Magna International | MG:CA | Cons. Discret. | $5,060.30 |

| National Bank | NA:CA | Financials | $12,288.76 |

| Royal Bank | RY:CA | Financial | $8,520.20 |

| Cash | $118.44 | ||

| Total | $96,331.07 |

My account shows a variation of +$657.30 (+0.7%) since the last income report on April 4th. There were a couple of companies left to report their earnings in April, and below is an update on those stocks.

Brookfield Renewable is on a roll!

Brookfield Renewable (BEPC:CA) (BEP, BEPC) reported a solid quarter with double-digit growth (FFO per share was up 13% while revenue was up 17%). The results reflect robust hydro generation, strong realized power pricing and asset availability, and contributions from growth. Again, Brookfield proves that its business model is sheltered from inflation. Management has been busy signing transactions for almost $8 billion of equity investments alongside their institutional partners. This included investments in power technologies and regions where BEP has deep operating and development expertise.

Fortis is also on a roll!

It was a good quarter for my utilities! Fortis reported a solid quarter with EPS up 17%. The increase reflected rate base growth, mainly at ITC and the western Canadian utilities, as well as higher earnings at UNS Energy. Market conditions resulted in wholesale electricity sales with favorable margins and higher transmission revenue at UNS Energy. Higher retail electricity sales, including the impact of favorable weather, and lower depreciation expense associated with the retirement of the San Juan generating station in June 2022, also contributed to results in Arizona. Fortis also announced the recent sale of Aitken Creek Natural Gas Storage Facility to Enbridge for $400M.

Magna International reported declining EPS but did better than expected!

Magna International did better than expected as revenue jumped by 15%, but EPS was down 9% but still beat the analysts’ expectations! The decrease in EPS mainly reflected higher net production input costs, operating inefficiencies at a facility in Europe, higher net engineering costs, lower net favorable commercial resolutions and higher net warranty costs. Based on the big earnings beat, management raised its adjusted EBIT margin outlook range to 4.7% to 5.1% from their prior outlook range of 4.1% to 5.1%. We want that margin to expand! Total sales are forecast to range from $40.2B to $41.8B. Net Income attributable to Magna is expected to range from $1.3B to $1.5B.

Here’s my US portfolio now. Numbers are as of May 8th, 2023 (before the bell):

U.S. Portfolio (USD)

| Company Name | Ticker | Sector | Market Value |

| Activision Blizzard | ATVI | Communications | $8,816.00 |

| Apple | AAPL | Inf. Technology | $13,017.75 |

| BlackRock | BLK | Financials | $9,022.72 |

| Disney | DIS | Communications | $4,523.40 |

| Home Depot | HD | Cons. Discret. | $8.688.60 |

| Microsoft | MSFT | Inf. Technology | $17085.75 |

| Starbucks | SBUX | Cons. Discret. | $9,112.85 |

| Texas Instruments | TXN | Inf. Technology | $8,291.00 |

| Visa | V | Inf. Technology | $11,589.00 |

| Cash | $521.44 | ||

| Total | $90,668.51 |

The US total value account shows a variation of -$332.70 (-0.37%) since the last income report on April 4th. We have a good line-up of results to digest from this portfolio:

Activision Blizzard did well, but the merger with Microsoft is shaky

Activision Blizzard (ATVI) reported a good quarter (revenue +25%, EPS +24%), but the big news was about UK regulators deciding to shut down the deal with Microsoft. That sent the shares lower despite great results. U.K.’s regulator blocked the deal citing concerns about cloud gaming. MSFT and ATVI announced they will fight back. ATVI reported strong growth as the net bookings for their franchise games (Call of Duty®, Candy Crush®, Warcraft®, Overwatch®, and Diablo®) were quite strong this quarter (+25%). For the next quarter, ATVI expects 10% revenue growth mostly driven by the new version of Diablo coming out in early June.

Apple didn’t impress, but it bought back a lot of shares!

Apple (AAPL) did better than expected despite declining numbers (revenue down 3%, EPS flat). iPhone sales rose by 1.5% and services went up by 5%. However, results were offset by declining sales for Mac (-32%) while Wearables, Home and Accessories sales were flat. Sales were down in North America (-7%) and China (-3%) as the country is slowly getting back to normal after a long episode of multiple lockdowns due to Covid. Apple announced a $90B share buyback program along with a 4.3% dividend increase. Slowly but surely, Apple is getting back closer to its all-time-high price.

BlackRock continues to struggle, but it’s okay.

BlackRock (BLK) reported declining numbers (revenue and EPS both down 10%) but did better than expected for earnings. As we still have much volatility in the markets, the interest in bonds is increasing. BLK led the industry with $34B of bond ETF net inflows, accounting for over 60% of total fixed-income ETF trading volume. Overall, assets under management (AUM) grew 5.8% sequentially to $9.09T, with an average AUM totaling $8.9T. Long-term net inflows reached $103B. EPS was down driven by the impact of significantly lower markets and dollar appreciation on average assets under management and lower performance fees.

Microsoft is a beast; did I ever mention that?

Microsoft pleased investors with a strong quarter beating analysts’ estimates (EPS up +10%, revenue +7%). Strong results were driven by Productivity and Business Processes (+11%) and Intelligent Cloud (+19%), but partially offset by More Personal Computing (-9%) and currency headwinds. The big news was about Azure and other cloud services being up 27% and showing strong potential with the development of artificial intelligence (Open AI uses Azure). Windows and devices revenues were down 28% and 30% respectively, but Xbox revenue was up 3%. MSFT is still battling to acquire Activision Blizzard after UK regulators blocked the deal. They are going to appeal, so stay tuned!

Starbucks sells expensive coffees in very large volumes!

Starbucks reported a strong quarter with double-digit growth (revenue +14%, EPS up 25%) and beat analysts’ expectations. The coffee chain reported global comparable store sales +11% during FQ2 to smash the consensus estimate of +7.3%. Average ticket was up 6% and transactions were up 4%. Comparable sales increased in North America (+12%) and on international markets (+7%, China +3%). The operating margin increased (from 13% to 14.3%) due to strategic pricing, sales leverage, productivity improvement, and lapping COVID-19 related pay. SBUX opened 464 net new stores and it ended the period with a record 36,634 stores globally.

Texas Instruments is in the middle of a down investment cycle

Texas Instruments did better than expected even though numbers weren’t great (revenue -11%, EPS -30%). However, the company disappointed the market with weaker guidance than expected for the next quarter. TXN said it expects earnings to be between $1.62 and $1.88 per share with sales forecast to be within a range of $4.17B and $4.53B. Analysts were expecting second-quarter earnings of $1.83 per share and $4.44B in revenue. TXN is navigating through a down investment cycle in the semiconductors industry. It will likely show weak results for the rest of 2023. This could open the door for a good stock purchase opportunity.

Visa is killing it; what’s new?

Visa (V) reported another strong quarter with double-digit growth (revenue +11%, EPS +17%), beating analysts’ expectations. Visa’s business model is all about volume and transactions. Payment volume increased by 7% while total cross-border volume on a constant-dollar basis increased by 24% in the quarter. The Cross-border volume within Europe was even better at +32%. Transaction volume also increased by 12% in the quarter. Visa keeps on rolling as consumers are spending more and more often. At the end of the quarter, Visa was sitting on a big pile of cash (cash, cash equivalents and investment securities were $19.4 billion on March 31, 2023).

My Entire Portfolio Updated for Q1 2023

Each quarter we run an exclusive report for Dividend Stocks Rock (DSR) members who subscribe to our very special additional service called DSR PRO. The PRO report includes a summary of each company’s earnings report for the period. We have been doing this for an entire year now and I wanted to share my own DSR PRO report for this portfolio. You can download the full PDF showing all the information about all my holdings. Results have been updated as of April 6th, 2023.

Read the full article here