The Biden administration announced new student loan servicing contracts this week. These servicing contractors will administer the federal student aid system, including student loan forgiveness and repayment programs, on behalf of the Education Department.

The announcement comes as millions of borrowers are still contending with ongoing student loan servicing upheavals. But the changes are just one part of a larger effort across multiple administrations to make student loan servicing smoother and more centralized.

Here’s the latest.

Student Loan Servicing Has Been Bumpy For Borrowers

The Education Department contracts out student loan servicing operations to multiple third-party companies. These companies, called loan servicers, handle most day-to-day operations of the government’s sprawling federal student aid system. This includes taking payments, processing forms for repayment plans and student loan forgiveness, implementing deferments and forbearances, and fielding calls from borrowers.

Borrowers have already had to contend with significant student loan servicing changes during the last three years:

- FedLoan Servicing, which had handled the troubled Public Service Loan Forgiveness program, completed its withdrawal from the federal student loan servicing system last year. MOHELA has now taken over the program.

- Navient also recently withdrew from the Education Department’s student loan servicing system. Another company, called Aidvantage, took over many Direct student loan accounts (Navient still services private student loans and some commercially-held FFEL-program loans).

- Great Lakes Higher Education is currently in the process of transitioning many accounts to Nelnet

NNI

Student loan servicer changes do not change ownership of a federal student loan, and the underlying terms and conditions of the loan remain in place. Nevertheless, loan servicing transfers have historically been disruptive for borrowers. The Consumer Financial Protection Bureau noted in a 2015 report that servicing changes can result in lost payments, surprise late fees, paperwork processing problems, and missing records, all of which can result in borrower confusion and even cause some borrowers to fall behind on their payments.

Consumer advocates have already been raising the alarm about recent loan servicer transfers. Borrowers whose loans were transferred to MOHELA reported major paperwork processing delays and long call hold times, although anecdotal reports indicate that these issues are improving. Meanwhile, Nelnet recently announced layoffs in its student loan servicing division, even as the company acquires more accounts from Great Lakes Higher Education and millions of borrowers are expected to resume repayment as the federal student loan pause ends this summer.

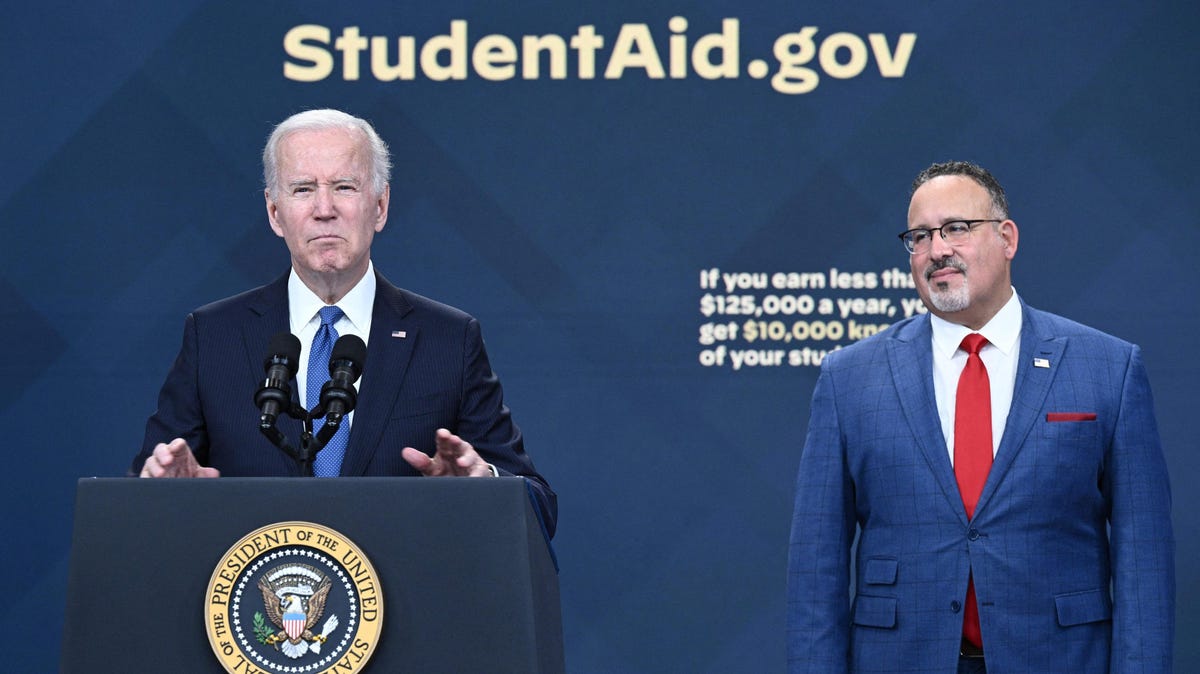

Biden Administration Announces New Student Loan Servicing Contracts

The Biden administration announced earlier this week that the Education Department awarded new student loan servicing contracts to five companies. Four of these companies — MOHELA, Nelnet, EdFinancial, and Maximus Education (which operates Aidvantage) are existing student loan servicers. A fifth company, Central Research, Inc., is new to the department’s loan servicing space. This means that some borrowers may see their federal student loan accounts transferred to this new company.

Education Department officials stated that the new servicing contracts would be good for borrowers in the long run, as they incentivize better customer service and provide greater accountability. “The Biden-Harris Administration is fixing broken programs like Public Service Loan Forgiveness and writing the most affordable repayment plan ever, and the Department of Education is working tirelessly to implement these policies and maximize benefits for borrowers,” said Under Secretary of Education James Kvaal in a statement on Tuesday. “The contracts awarded today will combine more investment and more accountability to deliver higher levels of service to 37 million borrowers with federally managed loans, help them claim student loan benefits they have earned, and reduce the number of borrowers who fall into delinquency and default.”

Advocates for student loan borrowers praised the new accountability standards, but some expressed skepticism that some student loan servicers would be able to deliver, given their track record.

Any changes as a result of the new contracts won’t be felt immediately by borrowers, as the Education Department has extended existing loan servicing contracts through the end of 2024. However, servicing transfers that were already planned will continue.

New Contracts Are Part Of Larger Student Loan Servicing Overhaul

The new contracts are a prelude to a more sweeping student loan servicing overhaul that has been in the works for years, across multiple administrations. The end goal of the overhaul is to have StudentAid.gov, the Education Department’s federal student aid website, be the main portal for borrowers to manage their federal student loan accounts, without having to use their loan servicer’s website.

Currently, borrowers can already use StudentAid.gov for Direct loan consolidation, income-driven repayment recertification, and submitting applications for student loan forgiveness through Borrower Defense to Repayment and Public Service Loan Forgiveness. Officials hope to further centralize and streamline more student loan operations.

“Ultimately, the new loan servicing environment will provide all federally managed student loan borrowers with complete account management capabilities on StudentAid.gov; reduce disruptions from account transfers; and increase servicer accountability through clear, service-level metrics,” said the Education Department in a statement.

The implementation of the centralized student loan servicing system will continue to happen in incremental steps over the next several years.

“Because of the scope of this work, FSA will take a phased approach to implementing the new environment,” said the Education Department. “The long-term contracts awarded today will make major improvements when they go live in 2024. These include updated cybersecurity provisions and compliance with consumer protection rules as well as improved customer experience through a single sign-on using a borrower’s FSA ID, which will make it easy to navigate between servicer websites and StudentAid.gov. Over the five years of the base contract, FSA will continue to expand functionality on StudentAid.gov with the goal of transitioning full account management, branding, and repayment away from servicer websites.”

Further Student Loan Reading

To Qualify For Student Loan Forgiveness Under Adjustment, Do These Things, Says Education Department

GOP Targets These Student Loan Forgiveness Plans As Debt Limit Standoff With Biden Escalates

What The Supreme Court’s Latest Move Means For Student Loan Forgiveness

4 Critical Student Loan Forgiveness Dates Borrowers Should Know About

Read the full article here