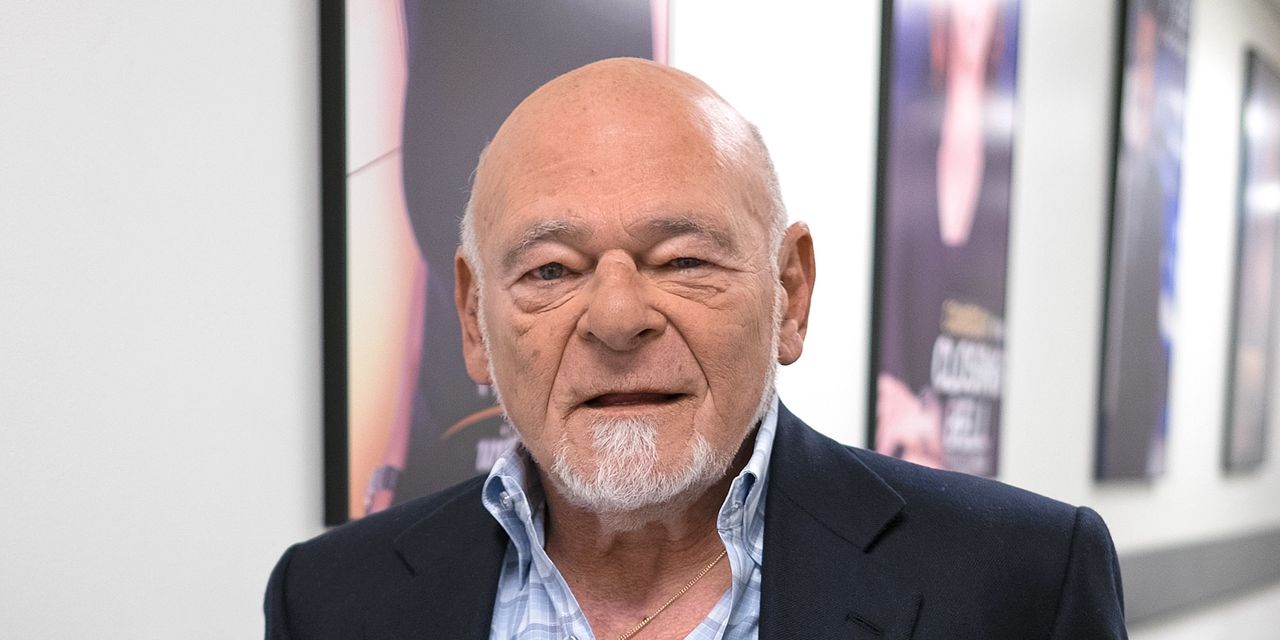

Sam Zell, a legendary real-estate investor who made billions scooping up distressed commercial properties, has died at 81, according to reports.

A message from Equity Residential

EQR,

where he was founder and chair, said that it was mourning the death of the prominent investor. “Mr. Zell was an iconic figure in real estate and throughout the corporate world [and] an active investor in real estate since the 1960s,” the Equity Residential statement said.

Zell is credited with popularizing the real-estate investment trust and was known sometimes as a “grave dancer” due to his penchant for acquiring distressed real estate.

The Chicago-based investor bought dozens of foreclosed office buildings in the 1990s at steep discounts, and eventually sold most of them through the $39 billion Equity Office Properties deal in 2007 to the private-equity firm Blackstone Group

BX,

one of his more prominent deals, the Wall Street Journal noted in 2021.

Zell was the chair of a number of real-estate companies, including Equity Residential, Equity LifeStyle Properties

ELS,

Equity Commonwealth

EQC,

Covanta Holding and Anixter International.

Equity Residential owns almost 80,000 apartments, and Equity LifeStyle is described as one of the country’s largest investors in manufactured homes.

Zell, born in Chicago in 1941, founded the predecessor company to Equity Residential while a student at the University of Michigan and took it public in 1993.

The real-estate mogul started his career as a lawyer before moving into properties, where he built a net worth of $5.2 billion, according to Forbes.

He purchased the Chicago Tribune and affiliated daily newspapers in a 2007 leveraged buyout, and with them the Chicago Cubs baseball team. The publisher filed the following year for Chapter 11 bankruptcy protection, and Zell left the company in 2010.

Zell is survived by his wife, Helen; three children; and nine grandchildren, according to the Wall Street Journal.

From the archives (March 2020): Billionaire Sam Zell says he’s buying at ‘ridiculously low’ prices in one particular sector amid market volatility

Read the full article here