I covered Copa Holdings, S.A. (NYSE:CPA) a year ago, and back then, I marked the stock a buy despite the risk of elevated fuel prices for a prolonged duration. Those that bought the stock have become the big winners, as Copa Holdings share prices have risen 48.2% compared to a slightly red market.

In this report, I will have a look at the first quarter results and the outlook for Copa Airlines. Furthermore, I will discuss whether I see additional upside after the nearly 50% in share price appreciation.

Strong Results For Copa Airlines

Copa Holdings

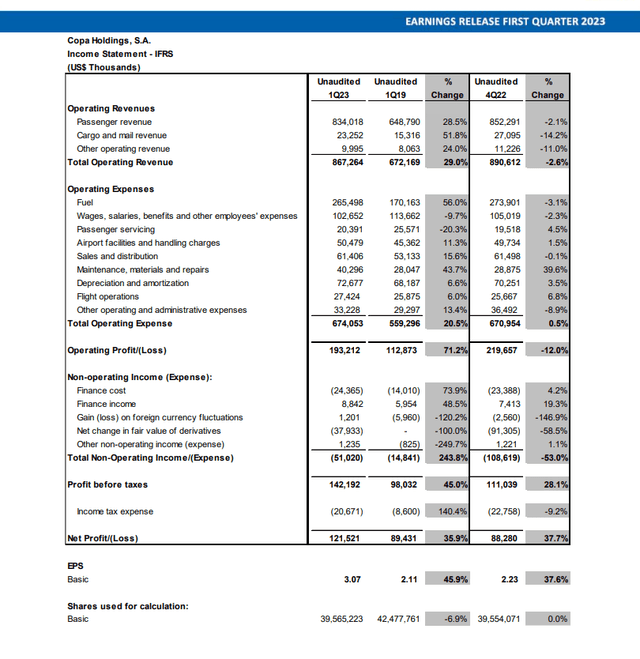

Copa Airlines is probably one of the few airlines that still uses comparisons between pre-pandemic levels, but I believe there is a good reason for that, as I will detail further on. Revenues grew 29%, which was helped by 25% higher unit revenues and 2.8% higher capacity, combined with a 3.5 percentage point increase in load factor. Costs increased by 20.5% driven by 61.4% higher fuel prices, partially offset by lower block hours and departures. Overall, revenue growth outpaced top-line growth, so Copa Airlines saw its profits expand significantly to $193.2 million.

With that in mind, the comparison to 2019 makes a lot of sense, and I can actually applaud Copa Airlines for providing this. Throughout the pandemic, many airlines provided comparisons to pre-pandemic levels because those were the revenue, capacity and profit levels that the companies were aiming to return to. However, with revenues and capacity largely recovered, companies reverted to year-over-year comps even though profits were not fully recovered. That is unfortunate, as I don’t believe the comparisons to pre-pandemic quarters should be made until the first full year that profits match or exceed pre-pandemic levels.

In that regard, Copa Airlines seemingly does the right thing, but it should be noted that the company’s prior year results were already exceeding pre-pandemic levels, so by now they could have reverted to year-over-year comparisons. Perhaps Copa Airlines is not doing this yet because, from a block-hour perspective, they are still flying 5% less. However, overall, the operational statistics look more than fine, with unit costs excluding fuel up only 2.1% which I believe is strong if you consider the inflationary pressures felt throughout the industry.

Copa Margins Are As Good As It Gets

Copa Holdings

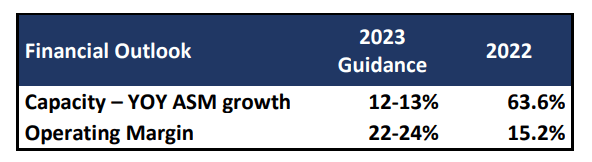

Copa Airlines is one of the airlines that I think is a front-runner in the recovery. The margins also show it. Q1 2019 margins were 17% and Q1 2023 margins are 22.3%, showing that not only did the airlines completely recover its capacity, but it is also recovered its profits and is already expanding. This does mean that with regard to upside to the margins, things are likely as good as they can get and that shows in the guidance for 2023 which includes 22 to 24 percent in operating margin for the full year and 12 to 13 percent capacity growth.

I believe there is some space to benefit from lower fuel prices and perhaps benefit on scaling the capacity even more and drive down unit costs. However, apart from that in the near term, I don’t see major drivers to further boost those margins.

Is There Upside Left For Copa Holdings Stock?

Copa Holdings

When going through the first quarter results and the guidance, the one question I had is, “After a 50% surge in stock prices and little margin upside for this, is the buy rating still valid for Copa Holdings stock?” I was inclined to say that is not the case, however, when putting the numbers in my valuation model, I found that Copa trades at 4.8x its expected EBITDA while the median for peers is 8x to 8.5x. So, there seems to be significant upside ahead to around $189 or 78% upside. Historically, Copa Airlines has traded at elevated levels which would unlock even more upside, but I am not factoring that in now as I believe 8x to 8.5x. Therefore, I am maintaining my Buy rating for Copa Holdings, S.A. stock.

Conclusion: Copa Airlines Remains Attractive

Airlines don’t make for the most attractive investments. I will be the first to admit that. However, if I look at Copa Airlines, I am seeing a lot of good things. The company has used the pandemic to grow stronger. Whether that will last remains to be seen, but the results that Copa Holdings, S.A. has shown almost looks like a gold standard for airlines, and the enterprise valuation and outlook for this year suggest that things could get even better.

Read the full article here