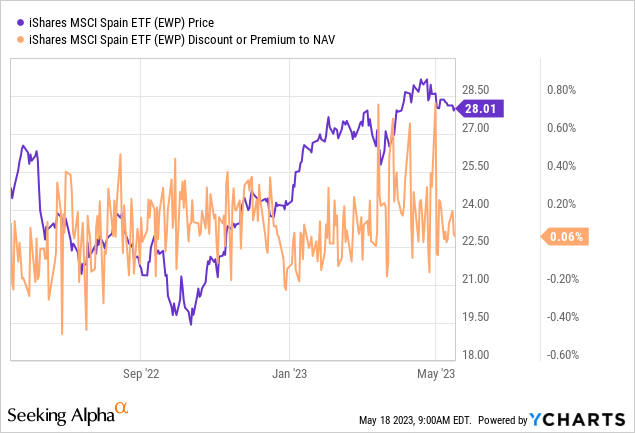

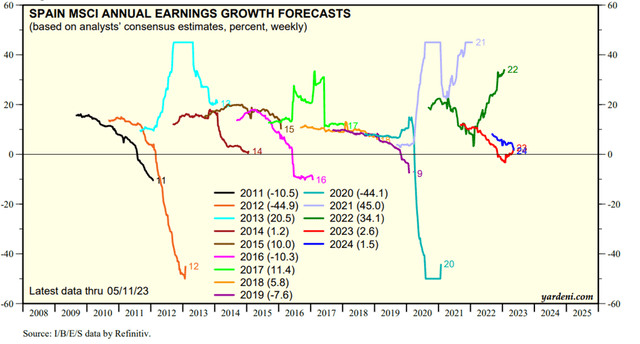

Spanish equities have been the surprise outperformer this year, as a significant drop in energy and commodities prices drove an improved economic and earnings outlook. Also supporting the economy was an extension of government/EU support measures, most notably from the ‘Recovery and Resilience Plan’ (financed by transfers from the EU’s ‘Recovery and Resilience’ Mechanism (NGEU)). But the sustainability of the current pace of growth remains unclear – as support from the reopening boost fades, manufacturing PMIs have already moved into negative territory, while the services expansion has also decelerated. And with credit conditions in Spain already tightening in Q1 ahead of >EUR1tn of TLTROs (targeted longer-term refinancing operations by the ECB) expiring from June, credit tightening could still accelerate from here. At ~11x P/E ratio for a portfolio of Spanish large-caps projected to grow earnings in the low-single-digits (~3% in 2023 and 1.5% in 2024), the iShares MSCI Spain ETF (NYSEARCA:EWP) doesn’t offer much value here.

Fund Overview – Low-Cost but Highly Concentrated Spanish Large-Cap Portfolio

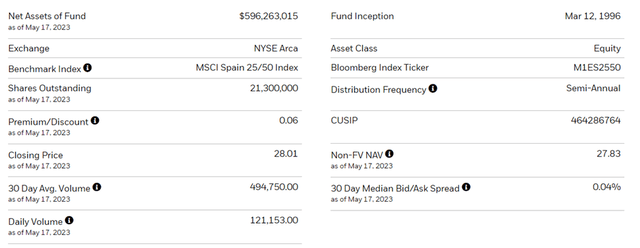

The US-listed iShares MSCI Spain ETF seeks to track, before fees and expenses, the performance of the MSCI Spain 25/50 Index comprising large and mid-cap Spanish equities (~85% of the free float-adjusted market cap). The ETF held ~$596m of net assets at the time of writing and charged a 0.5% expense ratio (in line with comparable iShares Euro funds), making it a cost-effective option for US investors looking to access Spanish-listed equities. A summary of key facts about the ETF is listed in the graphic below:

iShares

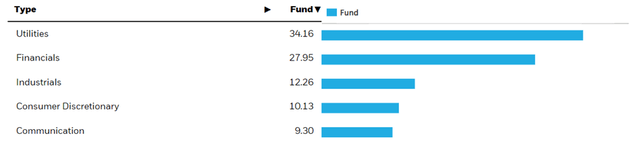

The EWP portfolio is fairly small, particularly by Euro area standards, at only 21 holdings. The largest sector allocation is Utilities at 34.2%, followed by Financials at 28.0% and Industrials at 12.3%. Other significant exposures include Consumer Discretionary at 10.1% and Communication at 9.3%, with the remaining sectors well below the 5% threshold. On a cumulative basis, the top five sectors accounted for ~94% of the total portfolio, making EWP one of the most concentrated Euro ETFs from a sector perspective. In line with the utilities-heavy exposure, the fund has a relatively low equity beta at 0.89 (vs. the S&P 500 (SPY)), reflecting its defensiveness against cyclical swings in the broader markets.

iShares

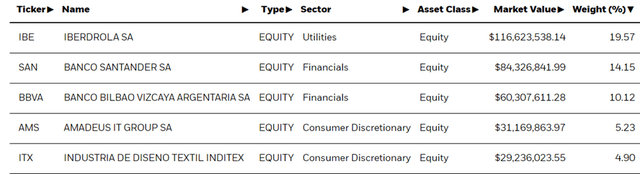

The single-stock allocation also stands out for its concentration, with the fund’s largest holding, electric utility company Iberdrola, S.A. (OTCPK:IBDRY), contributing 19.6% of the portfolio. The second-largest holding is financial services multinational Banco Santander (SAN) at 14.2%, followed by Banco Bilbao Vizcaya Argentaria, S.A. (BBVA) at 10.1% of the portfolio. Other key holdings include Spanish IT provider Amadeus IT Group, S.A. (OTCPK:AMADF) at 5.2% and Inditex (OTCPK:IDEXY) at 4.9%. In total, the top five holdings account for ~54% of the overall portfolio, making EWP one of the most concentrated iShares Euro ETFs. The fund’s underlying earnings and book value multiples stand at 10.7x and 1.3x, respectively, reflecting the focus on utilities and banks, which typically trade at relatively low multiples.

iShares

Fund Performance – Strong Capital Growth Track Record; Decent Yield

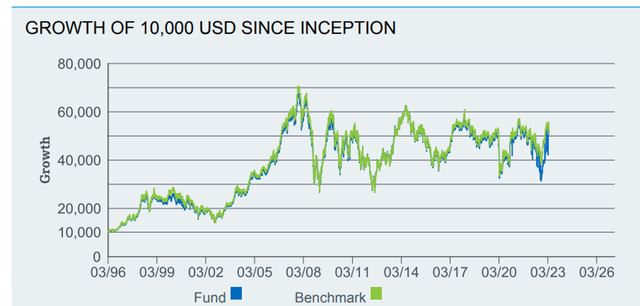

On a YTD basis, the ETF has outperformed its Euro area peers at +15.1% and has compounded at a steady +6.4% rate in market price and NAV terms (+5.8% net of taxes on distributions and share sales) since its inception in 1996. Outside of a >15% drawdown in 2018, the fund has generally experienced limited volatility through the cycles; even through a challenging 2022, EWP only declined ~5%. The one and three-year annualized returns screen favorably at +12.6% and +14.1%, respectively, helped by a COVID-impacted base. Zooming out, though, overall returns have been lackluster in the last five to ten years at +0.1% and 3.4%, respectively, with the vast majority of the fund’s long-term capital growth realized prior to the 2007/2008 financial crisis.

iShares

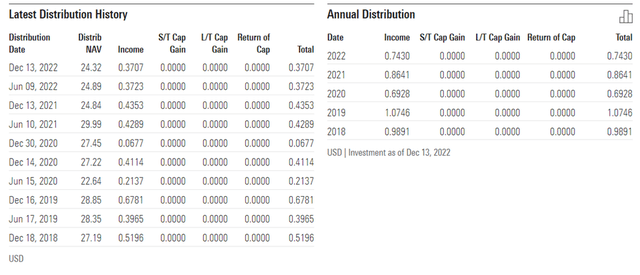

The distribution (paid on a semi-annual basis) has also been solid through the cycles, benefiting from the fund’s concentration in highly cash-generative, defensive names. And at a trailing twelve-month yield of 2.6%, EWP remains one of the most attractive Euro area ETFs for income investors. Growth investors may want to look elsewhere, though – per consensus estimates, Spanish large-caps are only set to grow their earnings in the low-single-digit percentages through 2023/2024.

Morningstar

Spanish Economic Resurgence Under Threat as Major Headwinds Loom Large

Despite the rampant inflationary pressures and steep interest rate hikes to combat inflation expectations in recent months, the Spanish economy has held up surprisingly well, outpacing the Euro area at +5.5% GDP (vs. +3.5% for its peers). But as we move past the COVID-impacted base and with GDP already near pre-COVID levels, the reopening boost is largely at its final stages. Thus far, the non-services sectors have struggled to keep up – following a substantial pullback in investment levels through Q4 last year, manufacturing PMIs have begun to signal an underlying contraction (the April print was <50). Some of this weakness will be offset by services, which continued to grow strongly on the back of a tourism boost (up >40% YoY to 13.7m international visitors in Q1); though with the services PMI index also decelerating to 57.9 in April (vs 59.4 prior), I wouldn’t be too optimistic.

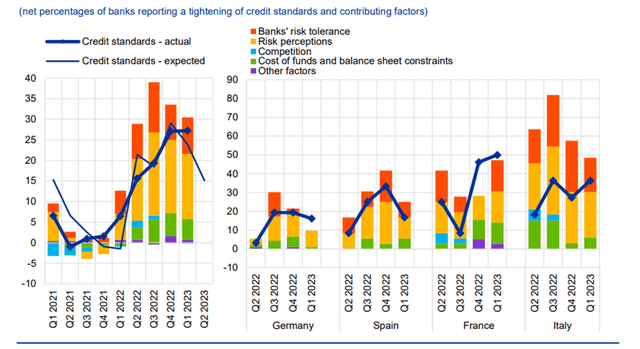

Perhaps more concerning, in my view, is the sustainability of the current pace of growth in the face of mounting credit tightening pressures. On the banking side, the key headwind is the pending TLTRO expiry from June onward (>EUR1tn due) and the implications for funding. Intuitively, a higher-cost funding regime should entail a pullback in lending activity and, alongside the ECB’s extended tightening cycle, an accelerated transmission to the real economy. The issue is that the Spanish economy isn’t in a position to absorb this shock, given the April Bank Lending Survey showed credit conditions in Spain have significantly tightened in Q1 for businesses, homes, and consumers. Thus, all signs point to growth decelerating in the coming months, led by reduced investment levels from corporates and consumer spending, as households contend with higher variable rate mortgage repayments. With limited fiscal runway to offset the shock as well following last year’s public spending spree (e.g., the ‘Recovery and Resilience Plan’), corporate earnings are vulnerable to downward revisions in the coming months.

ECB

Conclusion

Having suffered the most from the energy and commodities price shock post-COVID, Spain has benefited from the cyclical downswing in recent months, with economic growth now back on the agenda. With the benefits of fiscal support, most notably the Spanish government’s EU-financed ‘Recovery and Resilience’ package also filtering through to the economy, MSCI Spain has seen consecutive months of net earnings revisions. But the benefits have likely been priced in at EWP’s ~11x P/E valuation, which seems pricey relative to the portfolio’s low-single-digits earnings growth outlook. And Spain still has some big headwinds to navigate, particularly on the credit side, with >EUR1tn of TLTROs due in June and the ECB committing to an extended tightening cycle. There have been early signs of a real economic impact as well – the Spanish manufacturing PMI print sank below 50 last month, while the Q1 April Bank Lending Survey indicates conditions are already tightening. All in all, I would be cautious about chasing the EWP rally from here.

Yardeni

Read the full article here