Investment Thesis

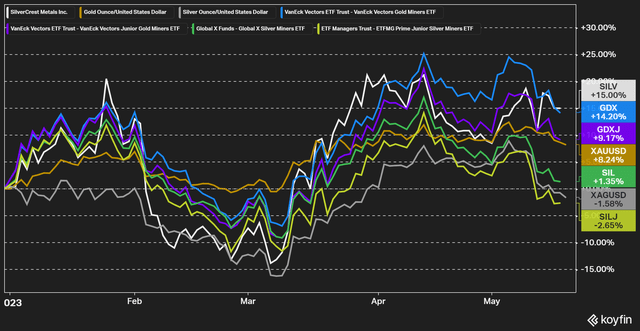

SilverCrest Metals (NYSE:SILV) released its Q1-23 results late last week and hosted a conference call as well. These are my takeaways of the results. Year to date, the stock price has outperformed gold, silver, and most silver mining peers, that have generally lagged the gold miners by quite a bit lately.

Figure 1 – Source: Koyfin

The market really liked the Q1 results from SilverCrest and I have to agree, there was very little to complain about.

With the latest share price and the share count from Q1-23, SilverCrest has a fully diluted market cap of $1,016M and an enterprise value of $993M.

Q1-23 Result

The company reported $58M in sales during Q1-23, $27M in net income, and $36M in adjusted operating cash flow. These are excellent numbers for a mine that reached commercial production as recently as Q4-22.

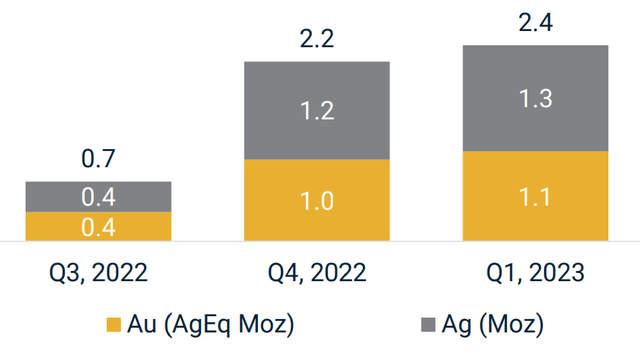

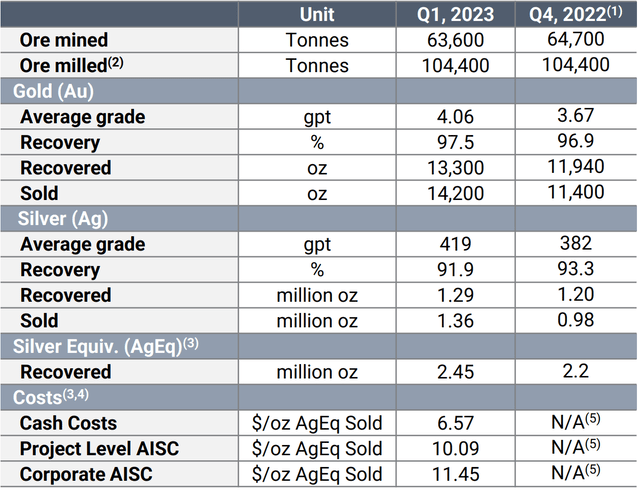

Figure 2 – Source: SilverCrest Corporate Presentation Figure 3 – Source: SilverCrest Corporate Presentation

Q1-23 was the first quarter where the company provided a complete cost breakdown, and we were looking at $6.57/oz in cash cost and an AISC of $11.45/oz in the quarter. However, the costs are likely somewhat below what we can expect going forward. We will get more clarity on the costs by the end of Q2, when the updated technical report is due to be released, but my expectation is for AISC to land somewhere in the $12-$14/oz range.

The one very minor concern is that the underground capital development is tracking behind the plan, but it is not something that concerns management. The smart decision to start early has led SilverCrest to have a substantial above ground stockpile of material, which is currently complementing the underground mining ramp-up. In Q1-23, the processing plant got about 60% of the material from the underground mine and the remaining 40% from the above ground stockpile.

SilverCrest produced 2.4M silver equivalent ounces in the most recent quarter, which likely takes the annual production to somewhere around 10Moz AgEq going forward.

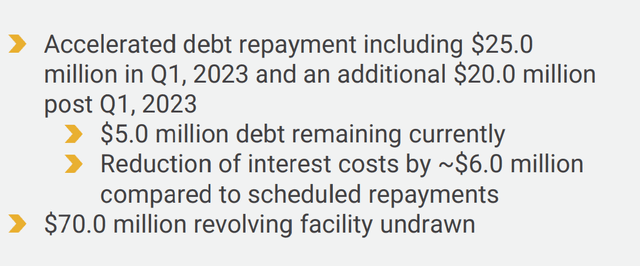

Figure 4 – Source: SilverCrest Corporate Presentation

The liquidity position is very strong at the end of Q1, with a negative net debt and a working capital of $71M. The company has so far focused on repaying the debt, which is almost done. On the conference call, the company did confirm that there will be a board meeting during the summer, following the release of the updated technical report, to decide on the best use of the cash flows.

There is no doubt SilverCrest will generate substantial cash flows going forward. The one thing we already know is that SilverCrest will keep some of its liquidity in bullion rather than cash, which I think is both a prudent capital allocation decision, but also a good marketing strategy, as it will appeal to many investors in the industry.

Valuation & Conclusion

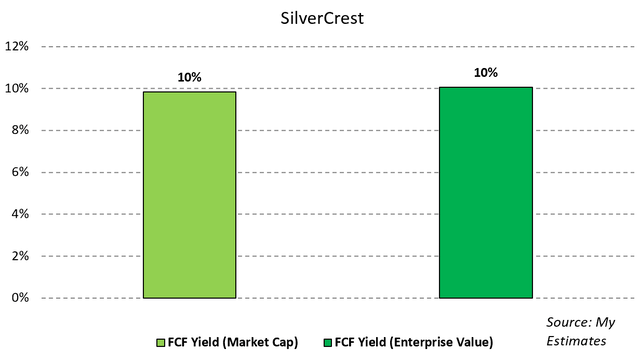

Even if we have to wait another month or so to get more clarity on the costs going forward, let’s assume we are looking at an AISC of $13/oz, which is probably a reasonably good estimate. With a silver price of $23/oz and an annual production of 10Moz AgEq, we are looking at somewhere around $100M in free cash flow per year. That translates to a very attractive FCF yield of around 10%, despite the fact that the stock price has done well so far this year.

Figure 5 – Source: My Estimates

There are silver miners which are far cheaper than SilverCrest based on net asset values or projected net present values, but the company is far from expensive based on earnings or cash flows.

SilverCrest is one of the very few mining companies, despite being a single asset producer, that in my view deserves a premium valuation. It is partly because of the excellent high-grade asset Las Chispas, but also because of a very good management team, which is rare among the smaller precious metals mining companies.

If you like this article and is interested in more frequent analysis of my holding companies, real-time notifications on portfolio changes, together with macro and industry analysis. I would encourage you to have a look at my marketplace service, Off The Beaten Path.

I primarily invest in turnarounds in natural resource industries, where I have a typical holding period of 1-3 years. Focusing on value offers good downside protection and can still provide great upside participation. My portfolio generated a return of 81% during 2020, 39% in 2021, -8% in 2022, and is up 2% in March of 2023.

Sign up!

Read the full article here