Any stocks tangentially having to do with artificial intelligence have seen rallies of 50%, 100%, or more in a matter of months. However, while the technology is brand new, the underlying cycle of hype and disappointment is as old as time. During the dot-com bubble, random companies would add “.com” to their company name and see their shares bid to the moon. Later on, most of these same companies quietly folded after losing all of their investors’ money. These patterns were seen before in bubbles like the 1800s railroad bubbles, the early 1900s automotive bubble, the 1920s stock market bubble, and the “nifty fifty” bubble in the 1960s. More recently, these same patterns have played out in cannabis stocks, sports betting stocks, and blockchain.

Remember Bioptix? Bioptix was a veterinary products company that suddenly changed its name to Riot Blockchain (RIOT) in 2017 to capitalize on crypto hype. The name change immediately drove the stock up 400%, and management later settled charges with the SEC for market manipulation. Some of these same patterns are now playing out in the AI space, and there is sure to be a glut of “AI opportunities” pitched to gullible investors. History is also likely to repeat itself in Big Tech, where paying ever-greater valuations for the same dollar of earnings since 2018 will lead to the same poor results it has for the entirety of human existence.

Lessons From The Dot-Com Bubble

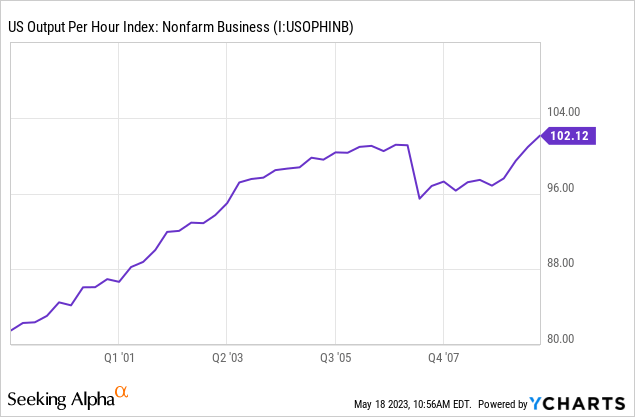

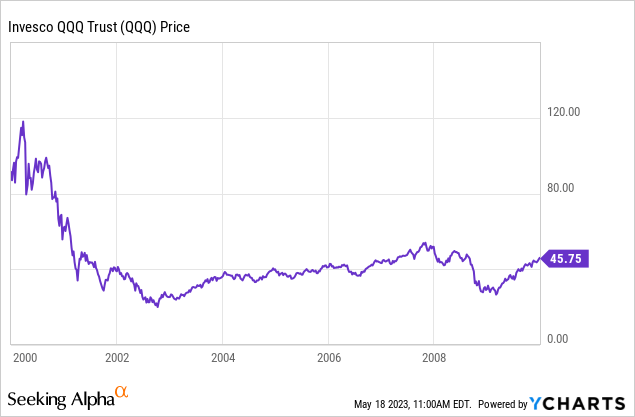

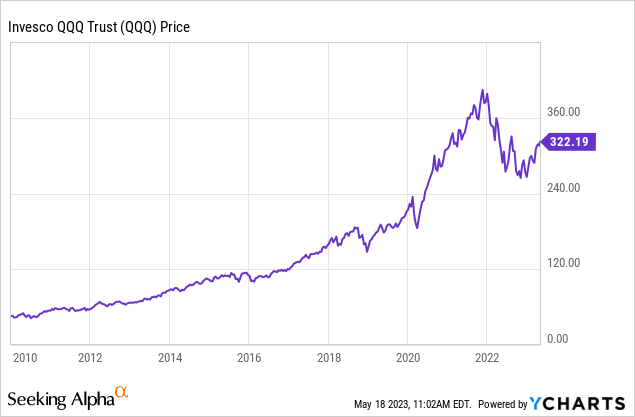

The widespread adoption of the Internet in the 1990s led to large and sustainable gains in economic productivity. Those who invested in the right companies saw their fortunes balloon, and the standard of living in the US rose as well. Investors who bought the NASDAQ (QQQ) in the late 1990s and early 2000s correctly foresaw a boom in labor productivity in the US in the 2000s.

In real terms, my numbers show that US labor productivity rose about 31% from 2000 to 2010.

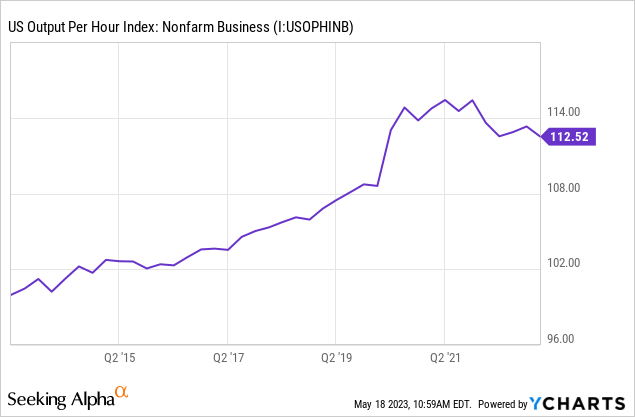

That’s a huge gain and one that wasn’t repeated in the 2010s. Since 2010, the pace of labor productivity gains has slowed markedly. Over the past 10 years, labor productivity is only up about 12%.

Of course, during the time that technology really was driving labor productivity much higher, the NASDAQ was crushed.

And when labor productivity and GDP came in lower than expected, the NASDAQ soared. Why? Because investors in the first case paid far too much, while in the second case, the NASDAQ was an amazing bargain.

I think this is incredibly instructive. Paying too high of a price crushed investors who correctly forecasted long-run economic trends, while getting a bargain purchase price made many NASDAQ investors in the 2010s rich.

So where are we now?

The current market is a weird market because you have banks and small-caps trading at very low valuations, but some mega-cap tech stocks and AI names are trading for extremely high valuations. Even the bellwether blue chips are trading for alarmingly high valuations. This is known as a lack of breadth, and it’s generally a sign that the rally is nearing exhaustion.

- Microsoft (MSFT) is trading for a 33x PE. MSFT has legitimate opportunities combining cloud computing and artificial intelligence but is now priced too high.

- Apple (AAPL) is at 29x. These two stocks make up nearly 14% of the S&P 500.

- Nvidia (NVDA) is trading for a 66x PE ratio, up 119% in 4.5 months.

- AMD (AMD) is up 67% for the year, 36x PE.

- Google (GOOG) rallied hard, then was ridiculed for being “behind” on AI after a bungled AI presentation, and now is up 37% for the year, having ceased to be a value stock in short order.

- C3.aI (AI) has the best ticker symbol in the world right now but has had five CFOs since 2019. There are a lot of accounting allegations and counter-allegations with this company.

Other companies with little or nothing to do with AI have simply whispered the words “artificial intelligence” in their quarterly conference calls and collected a share price premium from starry-eyed investors looking to get in on the next big thing. There will be many legitimate uses for AI, but be wary of anyone trying to convince you that this time is different.

Will AI Boost The Economy?

Now, analysts are calling for big gains in productivity and GDP. The boldest claim comes from Cathie Wood, who claims that AI will cause GDP to grow 50% per year. But is this realistic? History may offer clues.

The 2000s saw a burst of productivity growth from an improvement in communications and internet adoption. Offices that were previously stuffed with paperwork increasingly were able to rely on the Internet to do things faster, better, and cheaper.

- Millions of other businesses that relied heavily on call centers found that customers could book online. Businesses like airlines made huge gains and were able to close call centers and physical offices which cost money. Even old-time Texas bookmakers who embraced technology saw similar gains.

- Mountains of medical records moved to computers, dramatically cutting the burden of tracking down paperwork for the healthcare industry. This was mirrored among businesses in other industries as well.

- Cell phones further cut time lapses in communication, allowing workers to be more productive and turn around tasks quicker.

- Robotics and automation improved manufacturing at a steady pace.

- The internet allowed smart people to get much smarter, to read research published around the world, and to publish their own research. Whether AI is able to do better than millions of smart people doing research is an open question. AI should help make incremental improvements, but I wouldn’t expect any fireworks compared with the current pace of innovation. Good ideas are cheap, but executing them is often expensive and hard.

These factors and many more like it pushed labor productivity higher. But it wasn’t enough for investors to turn a profit investing in stocks during the decade!

The 2010s saw some gains as well due to the adoption of the iPhone, Uber (UBER), Airbnb (ABNB), et cetera. However, labor productivity actually rapidly slowed in the 2010s. The pandemic seemed to have unlocked a bump in productivity (maybe from work-from-home, maybe simply from companies laying off more low-wage workers). However, productivity in the US is now going down! Since the introduction of ChatGPT late last year, labor productivity in the US is down about 0.5%! Ultimately, GDP growth and labor productivity do drive stocks, but the performance relative to expectations is what determines whether investors do well in the short run. Now, there are some signs that the economy is due for problems going forward despite the current boom.

So what’s going on?

- The number one reason in my mind that labor productivity is slowing despite increasing automation is because of the opioid crisis. Millions of people in the US alone are addicted to drugs, and as a result, are not doing well. So far, this effect has been a more powerful drag on the economy than AI has been a boost. The most read piece on Bloomberg the other day was a piece on a West Coast tech executive with a crystal meth addiction that worsened during work-from-home. You can see the rise of disability, addiction, and overdose deaths in various economic data, and there’s no real plan for the government to stop it. This is going to be a structural problem that’s going to affect growth. The experience of ex-USSR countries shows health outcomes tend to lead economic outcomes more than the other way around.

- The second reason I’d flag for this is that the demographics in the US are changing. People are getting older and sicker. As a result, automation is helping stem the decline rather than push through huge gains in productivity. AI is certain to help productivity, but you should try to identify where these breakthroughs will actually happen. I believe it’s likely that AI will lead to incremental changes, not a massive breakthrough.

- The third reason is cyclical. Labor productivity tends to peak at the top of the economic cycle.

Will AI Boost Corporate Profits?

Another interesting angle is the expectation that AI will boost corporate profit margins. This argument is closely tied to the labor productivity argument and has been advanced by analysts at Goldman Sachs, among other firms. Again here, I’m not convinced.

- Many of the technological advances of the last 10 years actually worked to decrease profit margins! FaceTime and WhatsApp destroyed telecom companies’ international calling fees by offering free calls, and Uber demolished the taxi industry. We’ll see what Airbnb does in the fullness of time, but my feeling is that it will structurally hurt the ability of hotels to make money. There is no guarantee that generative AI will increase profit margins for Big Tech at large. In fact, it may bust up some of the oligopolistic nature of the industry and work to decrease profit margins.

- A second reason has to do with the “marginal propensity to consume” of tech workers vs. shareholders. If AI causes Big Tech to lay off half its employees, then service providers that rely on highly paid tech employees will see their business dry up. If tech workers that spend 80-90% of their wages are replaced by corporate shareholders who save most of their profits, then economic inequality increases and demand goes down. This might seem overly theoretical, but Henry Ford famously raised his employee’s wages so they would be able to buy the cars Ford made. By and large, automation is not good for the prospects of the middle class. This also has the effect of lowering tax revenues for the government, which might decide to tax corporate profits higher to make up for the shortfall. Layoffs are incredibly bad for morale as well. Unless the company is sold or restructured, management generally only resorts to layoffs to defend profit margins, not to attempt to increase them and boost the stock price.

- A third reason, which I think is the most important is that increases in profit margins over the past 15 years were not driven by productivity gains. In fact, increases in profit margins were very clearly driven by lower rates and income tax cuts. With these factors going into reverse, I think some tech investors will be unpleasantly surprised at their investment results going forward.

Bottom Line

While AI may be able to increase corporate profits, I would not take it for granted, and I would consider the headwinds facing corporate profits as well. These headwinds are hiding in plain sight and are far more powerful than investors give them credit for. Additionally, investors need to look in the trenches- labor productivity, inflation-adjusted revenues, margins- and not rely on hype to make investing decisions. With rapid PE multiple expansion in AI-adjacent stocks, I would take the recent rally as a reason to own less tech, not more.

Read the full article here