French dairy giant Danone (OTCQX:DANOY) delivered good results in Q1 2023 despite challenging macro conditions. Receding inflation is a positive for near term prospects while efforts to invest into its brands, and growth opportunities in plant-based beverages are potential positives for medium term prospects.

Good performance amid inflationary conditions

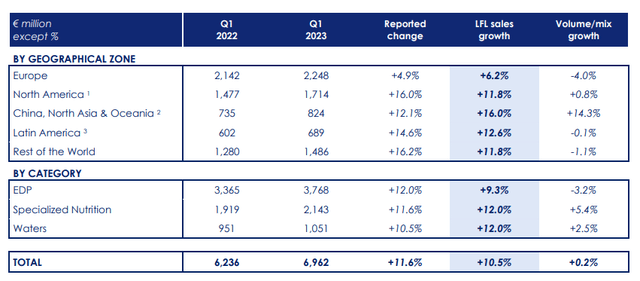

For Q1 2023 (quarter ended March 2023), Danone reported net sales of EUR 6.9 billion, up 11.6% on a reported basis and up 10.5% on a like-for-like (LFL) basis driven by pricing (+10.3%) and volume/mix (+0.2%). All regions and categories reported growth on an LFL basis, largely driven by pricing with limited impact to volumes.

Danone Q1 2023 press release

China, North Asia & Oceania was the fastest growing region with sales up 16% on an LFL basis, followed by Latin America (+12.6%), North America and the Rest of the World (+11.8%).

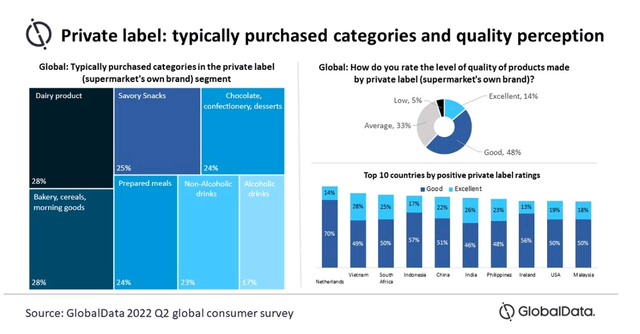

By category, Essential Dairy and Plant Based (EDP), Danone’s biggest segment by revenues accounting for 54% of the group’s sales, reported revenues up 9.3% on an LFL basis. EDP products mainly include yogurt and yogurt drink products (under brands such as Danone, Oikos and Activia), coffee products (such as coffee creamers and RTD coffee products under brands such as International Delight), plant-based beverage products (such as oat milk and soy milk under their Alpro and Silk brands), and new categories including ice cream, frozen desserts and cheese. The segment was largely driven by pricing (+12.5%) offset by a decline in volume/mix (-3.2%). With consumers feeling the pinch amid inflationary conditions, store brands are enjoying strong demand. Dairy as a category has among the highest exposure to consumer downgrades to store brands, Danone’s EDP business is likely to have been affected by the consumption downgrade trend. Nevertheless, Danone’s EDP performance is comparable to dairy rivals such as Nestle, who also reported high single digit growth for its dairy business in Q1 2023.

Food Processing Technology

Specialized Nutrition, Danone’s second-biggest business segment, accounting for about 30% of sales, saw sales rise 12% on an LFL basis. Specialized Nutrition covers Danone’s infant milk formulas and complementary food for babies, as well as pediatric and adult nutrition products under brands such as Aptamil, Cow & Gate, and Nutricia.

Waters, Danone’s smallest business, saw sales grow 12% on an LFL basis. Waters covers their mineral water and flavored water brands including Evian, Aqua, Font Vella, and Volvic.

Easing inflation, a positive for near term prospects

Near term, Danone’s prospects are positive. Inflationary pressures are showing signs of easing; after reaching record highs in 2022, world milk prices have been dropping since October 2022. Moreover, the IMF predicts inflation to drop to 6.6% in 2023 and 4.3% in 2024. Moderating inflation should not only help stall market share losses to private label brands but also ease margin pressures (Danone’s FY 2022 recurring operating margin dropped to 12.2%, from 13.7% the previous year).

China’s pandemic recovery presents a further positive for Danone near term. Summer season as well as increasing social activities could support sales of Danone’s water brand Mizone in China, while a recovery in tourism and hospitality along with a reopening economy could drive dairy demand. China is Danone’s biggest market after the U.S.

Overall, Danone upped their guidance for 2023, with LFL sales growth expected at 4%-6% for the year, up from 3%-5% previously. Recurring operating margins are expected to see a “moderate” improvement.

Looking ahead medium term…

Increased brand investments and sharpened positioning as a “health-focused” company could deliver positive results

Danone has allocated an extra EUR 300 million in advertising and promotion to build its brands over the next 24 months. Danone said it had reduced its advertising and promotion spend by 20% between 2017 and 2021, a move that impacted its market share in key markets such as France and the U.K. (its third and sixth-biggest markets respectively). For perspective, Danone’s selling expenses (which includes marketing expenses, consumer promotions and Salesforce overheads) amounted to EUR 6.2 billion in 2022 and accounted for 22.8% of sales for the year, roughly in line with 2021. The extra effort on brand investment could potentially deliver dividends in the future through increased brand loyalty, and sales.

Of note, Danone’s marketing strategy of positioning themselves as a “health-focused” brand could deliver meaningful results; the pandemic has brought on an increased focus on health and well-being and younger generations, particularly millennials and Gen Z are known to be more health conscious than older generations.

Danone‘s yogurt brand Activia for instance targets a health conscious demographic, with Danone highlighting the product’s benefits for gut health (possibly in response to a growing gut health trend worldwide). In addition, 70% of Danone’s alt-dairy product recipes are being updated to reduce sugar (a recent result of which appears to be Danone’s Silk NextMilk with 75% less sugar, launched this year together with Gen Z brand ambassadors like Brooklyn Beckham and Ella Travolta), and the company announced a commitment to never market HFSS products to kids as part of a strategy to be a ‘purpose-led, health-focused major food and drink company’.

In its water business, Danone has been revitalizing Volvic Touch of Fruit’s sugar-free range with new flavor launches (latest launches include raspberry & peach, and kiwi & lime) in an effort to capture growing demand for low-calorie, healthy hydration options (the global flavored water market is growing in the high single digits).

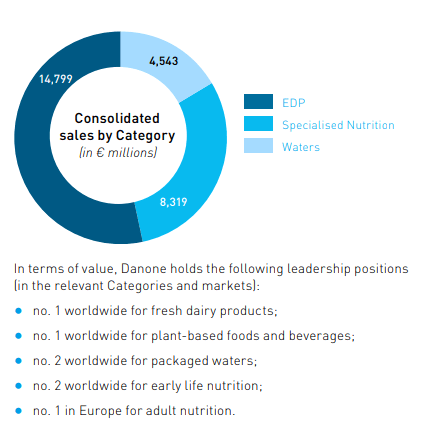

Tapping into opportunities in the market for plant-based dairy alternatives

Dairy in general is a relatively saturated market (with growth expected in the low single digits) but plant-based dairy alternatives are a significant growth opportunity. Danone is well positioned with a broad portfolio of plant-based dairy alternatives including oat milk, soy milk, and nut milks (under its Alpro brand in Europe and Silk brand in North America), non-dairy creamers (under brands Silk and Honest to Goodness), and yogurt alternatives (under its So Delicious, Activia, and Actimel brands).

The company continues to expand its vegan product range, recent efforts include the launch of new plant-based creamers in the U.S., the first plant-based medical nutrition beverage supplement under its Nutricia brand, and a plant-based infant formula under its Aptamil brand. As the world’s top player in plant-based food and beverage with expanding R&D facilities and extensive distribution networks worldwide, Danone could lean on scale advantages to capture a share of the growing plant-based dairy alternatives market worldwide.

FY 2022 Annual Report

Risks

Competitive risks

American Greek yogurt giant Chobani, who has proven to be a formidable competitor in the U.S. (Danone’s biggest market) where Chobani generates about 90% of its approximately USD 1.2 billion revenues, is aggressively expanding overseas (including New Zealand), into plant-based categories (like oat milk and plant-based creamers), and other food categories (like dairy creamers and coffee). The effort is part of Chobani’s effort to evolve from a yogurt brand into a total food company, stepping on rivals like Danone’s turf in the process.

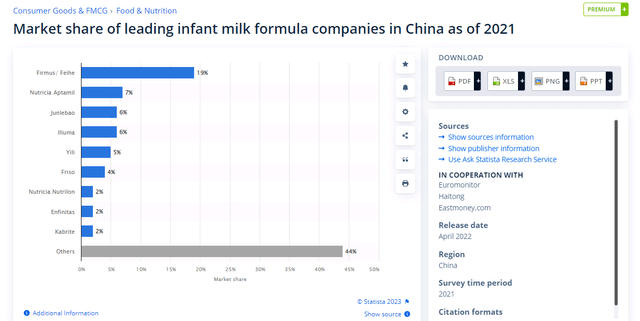

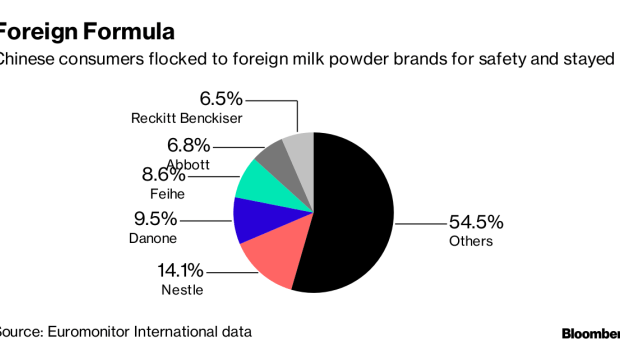

China, the world’s second-biggest dairy market after the U.S. and Danone’s second-biggest market after the U.S., is also highly competitive. Infant milk formula is Danone’s biggest business in China, and Danone’s Aptamil infant formula brand is currently the leading foreign infant formula brand with a market share in the high single digits according to Euromonitor. Infant formula is expected to be a declining market in China in the coming years as the country’s population shrinks and birthrates drop, and competition is intensifying; local infant formula brand Feihe (OTCPK:CFEIY) leads the market by a wide margin (with nearly a fifth of the market, more than double the 8% market share it had in 2017), and there are indications that infant formula is part of China’s “guochao” (national tide) trend which suggests heightening competition for foreign brands as local brands gain favor in the coming years.

Statista

Chinese parents are increasingly trusting local infant formula brands who collectively overtook foreign brands by 2020 with a combined market share of 53% of China’s infant formula market, a considerable change since 2018 when foreign brands like Nestle (OTCPK:NSRGY) (OTCPK:NSRGF) and dominated China’s infant formula market, a decade after the 2008 melamine scandal which caused local infant formula brands to lose considerable market share.

Bloomberg

Conclusion

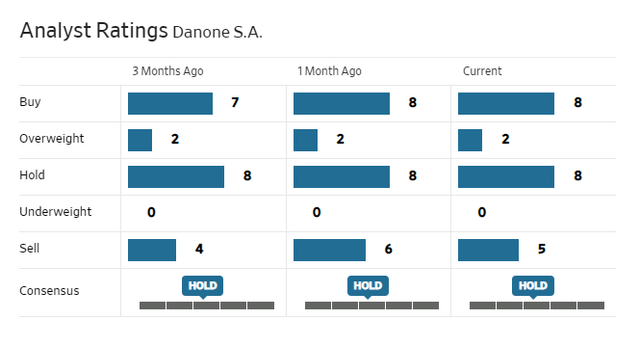

Analysts are split between buy and hold.

WSJ

With a forward P/E of 17, Danone is slightly cheap relative to rivals such as Nestle (21) but Nestle has better profitability metrics. For a mature company with stable prospects trading at a price that could be viewed as fair, Danone may be considered a hold.

|

Danone |

Nestle |

|

|

Gross margin % |

46% |

45% |

|

Net margin % |

3.5% |

9.8% |

|

Return on assets % |

4.6% |

7.1% |

|

Debt to equity % |

82.6 |

127 |

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here