Background

Apellis Pharmaceuticals (NASDAQ:APLS), is a US-based commercial biotech focused on innovative biologics that inhibit the complement system via C3 targeting. The firm’s innovative approach to treating complex diseases using C3 inhibitors such as pegcetacoplan has placed Apellis Pharmaceuticals as a key player in biotech.

To provide a quick summary of the company’s history and background, Apellis was founded in 2009 and is headquartered in Waltham, Massachusetts. The company has a strong, seasoned management team, including Cedric Francois, MD, Ph.D., who is the co-founder and CEO of the company with over 20 years of experience in biotech and has held leadership positions at several successful biotech companies.

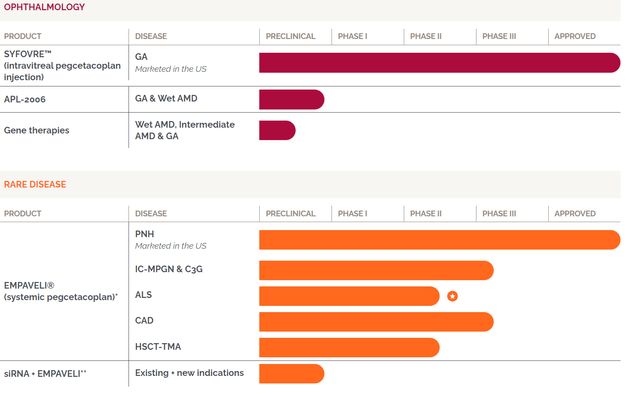

Pipeline overview

Pegcetacoplan is a conjugate of a compstatin analog that targets C3, the central protein of the complement cascade. It is formulated for both intravitreal administrations by injections directly into the eye and systemic administration by subcutaneous injection. Compared to other C3 inhibitors, Apellis Pharmaceuticals claims that its technology is unique because it selectively targets C3 and does not interfere with other parts of the complement system. This allows for more precise control over the immune response and potentially fewer side effects. Additionally, pegcetacoplan has a longer half-life than other C3 inhibitors, which may allow for less frequent dosing.

APLS pipeline summary (Company source)

PNH franchise

The company’s primary candidate, pegcetacoplan (Syfovre), a C3 inhibitor, has shown promising results in treating paroxysmal nocturnal hemoglobinuria (PNH), a severe hemolytic disease. The drug was approved by the FDA in May 2021 and received EU approval in December of the same year. Empaveli (systemic pegcetacopian) demonstrated superior efficacy to eculizumab in a Phase III trial for PNH patients and is expected to generate over $500 million in global PNH revenue.

Disease background

Paroxysmal Nocturnal Hemoglobinuria (PNH) is a rare and chronic blood disorder that primarily affects young adults. It is caused by the absence or deficiency of certain proteins on the surface of red blood cells, leading to their destruction and a range of symptoms, including severe anemia, abdominal pain, headaches, back pain, weakness, fatigue, and recurrent infections.

Currently, treatments for PNH include blood transfusions to manage anemia and anticoagulant therapy to prevent blood clots. However, these treatments do not address the underlying cause of the disease. We believe Empaveli is differentiated from current treatments for PNH as it targets the underlying cause of the disease by inhibiting complement-mediated hemolysis (which is the root cause of the disease that plays a pivotal key role in the development of PNH). This approach has shown promising results in clinical trials leading to its approval as a first-line treatment option for patients with PNH who are either treatment-naïve or switching from C5 inhibitors eculizumab or ravulizumab.

Key clinical data can be summarized as follows (trials)

- In a Phase III trial (n=80), patients with PNH treated with Empaveli showed a significant reduction in lactate dehydrogenase (LDH) levels compared to placebo at 16 weeks (-73% vs -0.2%, p<0.0001).

- The most common adverse events associated with Empaveli were injection site reactions and infections.

We note that Empaveli self-injector PDUFA was initially targeted for March 15, 2023, but the FDA has extended the deadline for the sNDA (no target date so far); we expect the FDA to come up with a more definitive deadline shortly.

Geographic atrophic (GA) franchise

Geographic atrophy (GA) is a disease that affects the macula, which is the central part of the retina responsible for sharp, detailed vision.

GA is a form of age-related macular degeneration (AMD) and is characterized by the progressive loss of retinal pigment epithelium (RPE) cells and photoreceptors in the macula. This leads to a gradual decline in visual function, including central vision, which can significantly impact daily activities such as reading and driving.

Syfovre received FDA approval for GA treatment in February 2023, and it is projected to yield >$1 billion in GA revenue by 2027. We highlight that Syfovre (pegcetacoplan injection) is the first and only approved treatment for GA. As Syfovre targets C3, the central protein in the complement cascade playing an important role in terms of tissue damage and inflammation, through inhibiting C3, Syfovre reduces inflammation and slows the progression of the disease. Of note, Syfovre, initially came up with mixed outcomes in the Phase 3DERBY and OAKS trials for Geographic Atrophy (GA). However, data released in August 2022 demonstrated compelling, sustained effectiveness.

The clinical trial data available on Syfovre’s efficacy comes from two Phase III trials called DERBY and OAKS.

- In DERBY trial (n=936), patients treated with Syfovre showed a statistically significant reduction in GA lesion growth rate compared to placebo at 12 months (-22% vs +9%, p<0.0001).

- In OAKS trial (n=1,041), patients treated with Syfovre showed a statistically significant reduction in GA lesion growth rate compared to placebo at 12 months (-16% vs +6%, p<0.0001).

The company recently published a phase 3 post hoc analysis during AVRO that demonstrated visual function and quality of life benefit vs. sham and photoreceptor RPE cell loss. Moving forward, we expect the company to publish more data on the 3-year GALE extension study and explore opportunities in additional indications (e.g., Stargardt disease), and further expand the development of APL-2006 for GA and wAMD in the future.

The Syfovre showed promising safety data.

The most common adverse events associated with Syfovre were injection site reactions, which were generally mild to moderate in severity. – The FDA granted Syfovre Priority Review and Breakthrough Therapy designation based on the positive results from the DERBY and OAKS trials.

Net-net, we are bullish on Syfovre due to a) Syfovre’s compelling mechanism of action and promising clinical trial data (summarized above) in a market without any approved treatment, we believe there is a high chance the drug to be a promising treatment option for patients with GA and full-fill the streets projection.

Potential label expansion opportunity

Aside from PNH, pegcetacoplan is undergoing crucial trials for other potential indications, such as Immune Complex IC-MPGN/C3G, ALS, CAD, and HSCT-TMA in collaboration with Sobi.

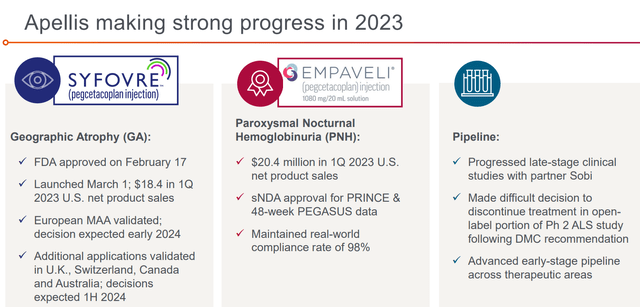

Commercial prints look better than expected.

Apellis making strong progress in 2023 (Company IR deck)

GA Q1 sales print

During the first quarter of 2023, Apellis reported impressive Syfovre sales of $18 million in geographic atrophy (GA), surpassing the consensus estimate of $2.5 million. The firm disclosed that over 6,000 vials were shipped to physicians during the initial five weeks of the launch, equating to approximately $11-12 million in demand. Also, the European MAA is validated, and the decision is expected by early 2024. Interestingly, the company is using samples of Syfovre to familiarize physicians with the drug and in order to integrate patients into their practice. Of note, as of the end of March 2023, more than 3,400 samples had been shipped. We believe the primary focus should be on Syfovre launch ramp speed and the initial metrics (provided by the company). So far, the early metrics are hinting at compelling demand for Syfovre in GA (Geographic Atrophy) treatment, and prescribers are enthusiastic about the product, which should be a net positive for the long-term trajectory of the ramp. Moving forward, as the company caveated investors in the short-term, we believe there is a potential element of disappointment as the Q1 sales were exceedingly positive until a permanent J-code is secured (expected by October 2023). However, we are net positive on the drug’s launch and believe it will reach the projected peak sales eventually.

PNH Q1 sales print

The company noted that Empaveli’s revenue in Q1 2023 was ~$20.4M, more than >200 patients were on commercial drugs, and >75% of C5 switches from Ultomiris showed strong adoption. Furthermore, the compliance rates remain close to 100% (~98%), which is highly promising as it means patients are not dropping out, validating the drug’s robust safety profile. Looking at the early launch trajectory, we expect the sales trajectory to continue to accelerate and reach close to ~$90M in 2023.

Solid cash runway

Apellis reported a $765.1M cash balance as of Q1 2023 (Q1 earnings call). The company estimates that the company’s cash on hand and cash generated by Syfovre and Empaveli will be enough to fund operations into Q1 2025, which is a highly reassuring cash runway for SMID cap biotech, and we believe potential dilution in the near future is unlikely.

Risks

-

Dependence on Key Drugs: Apellis’ financial health is heavily reliant on the success of its key drugs, particularly Syfovre and Empaveli. Any setbacks in their commercial performance can greatly impact the company’s revenue.

-

Pricing and Reimbursement: Insurers and healthcare providers may resist covering or prescribing Apellis’ drugs due to their cost. This could hinder drug sales and impact profitability.

-

Patent Protection: The company’s success relies on maintaining strong patent protection for its drugs. If patents expire or are challenged, it could open the door for generic competition.

-

Regulatory Approval for Geographic Expansion: Apellis’ future growth is partly dependent on receiving regulatory approval for its drugs in additional markets, like the European Union. Delays or denials could limit growth.

-

J-Code Acquisition for Syfovre: Apellis’ Syfovre is expected to obtain a permanent J-code by October 2023. Any delays or complications in obtaining this could impact the drug’s sales and the company’s financial outlook.

-

Label Expansion Risks: Apellis’ future revenue growth is partly dependent on successfully expanding the label for its existing drugs to cover additional indications. Failure in these trials could limit their market potential.

-

M&A Speculation Risk: The company’s stock price has been influenced by M&A rumors. If an acquisition doesn’t materialize, the stock may face downward pressure.

Conclusion

We initiate Apellis at a speculative buy rating based on the positive trajectory of Syfovre, solid cash runway, differentiated pipeline, and base technology. However, we caveat readers that the shares have not been trading rationally (or fundamentally) recently, and hype around M&A rumors is a key driver of the recent rise in stock price; therefore, there could be some short-term re-rating. Overall, we believe Apellis Pharmaceuticals has a strong track record of developing innovative therapies for patients (and crossing the finish line) with unmet medical needs and attractive economics and would be an excellent M&A candidate for big pharma.

Read the full article here