The video version of this article was published on Dividend Kings on Tuesday, May 16th.

—————————————————————————————

Midstream investors remember the dark days following the 2014 oil crash. For years, the industry struggled to adapt its business model from one reliant on cheap debt and stock financing to the gold standard of self-funding.

“Kindered” became a verb about midstreams who would buy out their MLPs and harm investors in the process, hitting them with tax bills and stealth dividend cuts.

Even Enbridge Inc. (ENB), the dividend aristocrat midstream king of risk management, was forced to buy out its MLPs is a way that hurt many long-term investors.

Well, M&A is back in the midstream space, but this time really is different.

Let me show you how ONEOK, Inc. (NYSE:OKE) buying Magellan Midstream Partners, L.P. (NYSE:MMP) is the new gold standard of how to do midstream M&A right and not hurt anyone in the process.

In fact, as I’ll show you, ONEOK’s acquisition of Magellan creates one of the most attractive 6.7% yields on earth and a potentially life-changing opportunity for income investors.

ONEOK Buying Magellan For $18.8 Billion

An Introduction To ONEOK

- ONEOK: Buy This 5.4% Yielding Retirement Dream Blue-Chip.

An Introduction To Magellan

- 8% Yielding Magellan Midstream Is A Dream Recession Retirement Strong Buy.

On May 15th, ONEOK announced it was buying Magellan Midstream Partners for $18.8 billion, including debt.

- 2nd largest midstream deal in history behind ENB buying Spectra for $28 billion.

ONEOK is paying $25/share in cash and 0.667 common shares of ONEOK for each outstanding Magellan unit.

In other words, OKE is paying $67.5 for MMP, a 22% premium to Magellan’s Friday closing price.

Upon receiving shareholder and regulatory approval, the deal is expected to close in Q3 2023.

News of the deal sent OKE shares down 9.1% while MMP soared 13%.

Why did OKE crash on the news? Two main reasons.

Why ONEOK Crashed On The News

OKE is paying $5.1 billion in cash for MMP. But OKE is a midstream company, and midstream, like real estate investment trusts (“REITs”) and Utilities, isn’t an industry where companies sit on cash.

- OKE has $220 million in cash

- $2.7 billion in liquidity from a $2.5 billion credit revolver.

In other words, OKE will have to borrow about $5.1 billion to complete this deal. For context, OKE’s debt is $13.6 billion right now, so it is almost doubling its debt, including the $5 billion MMP debt it’s assuming.

In addition, there is share dilution to consider.

- 207 million shares of MMP *.667 = 138 million more shares of OKE

- 449 million shares of OKE + 138 million new shares = 587 million post deal shares

- This represents 31% share dilution for OKE

- plus $10.1 billion in new debt

- when interest rates are much higher.

In addition, two analysts have raised questions about whether this deal makes strategic sense.

While it’s easy to see the attractiveness of acquiring refined and crude assets to diversify operations, OKE holders may have preferred the company to keep its natural gas and NGL focus and expand its footprint in Texas by acquiring G&P assets,” said Stifel analyst Selman Akyol, who rates the stock a Buy.

While viewing the deal’s tax benefits favorably and noting the deal diversifies Oneok’s cashflow, RBC’s Elvira Scotto was surprised given the two companies’ significantly different asset bases, and said she wants additional clarity on the strategic rationale, synergies, and cross-selling potential; she rates the stock at Sector Perform.” – Seeking Alpha.

However, these are just two out of 19 analysts; most like the deal.

Truist’s Neal Dingmann said Oneok is “well positioned for the deal given its prior substantial de-levering, providing strong balance sheet capacity,” and “the complementary nature of the assets could result in the company hitting at least $200M of operational synergies once the companies become fully integrated.”

The deal is “a bold move to redirect the long-term strategy of both companies, propelling the pro forma entity closer to the top of the class from a scale and diversification perspective,” Raymond James analysts said, adding they are “fans of consolidation in midstream.” – Seeking Alpha.

Morningstar especially loves this deal for both sides.

Broadly, we think the deal is an excellent one for both parties. It offers a compelling valuation for Magellan unitholders, well ahead of our stand-alone fair value estimate of $55 per unit. Further, with Oneok assets added to the equation, it provides ample opportunities to direct Magellan cash flows toward attractive investment opportunities, as Oneok has typically found no shortage of investment opportunities across its asset network, with $10 billion in growth capital expected to be invested between 2018 and 2023.

The deal removes a growing concern for Magellan unitholders, as growth capital spending levels of $120 million in 2023 are a fraction of pre-COVID-19 levels, raising more questions about future growth. The transaction also makes Magellan’s buybacks of $1.34 billion since 2020 at an average price of under $50 a unit a really good deal. Finally, Magellan unitholders will now own part of a corporation that is a member of the S&P 500, removing the risks of changes to the U.S. tax code either eliminating or reducing the tax advantages of master limited partnerships over the long run.

For Oneok, the deal adds a wide-moat partnership with an exemplary management team, throwing off very substantial cash flows. The quality of management is such that we hope that Oneok will seek to retain many of the key executives and senior managers, and we think the odds are decent, especially as Magellan CEO Aaron Milford only took over the partnership in early 2022.” – Morningstar.

And so do most rating agencies and the bond market.

Rating Agencies And The Bond Market Like This Deal

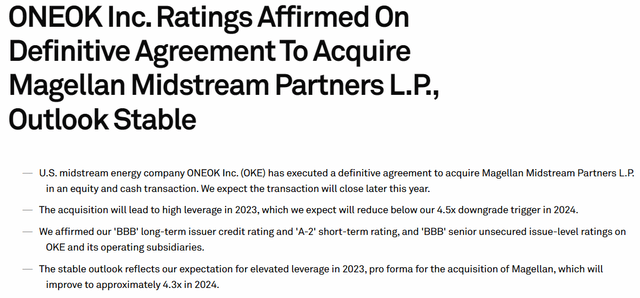

OKE’s strong BBB credit rating will remain intact.

- BBB from all rating agencies

- 7.5% 30-year bankruptcy risk.

S&P

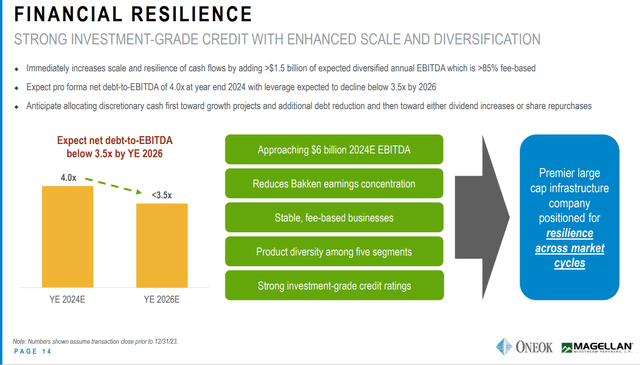

The industry guidelines for most midstreams are 5X or less debt/EBITDA, but it varies by company depending on the contract profiles and cash flow stability.

- MMP’s rating agency safety guideline is 4.0X debt/EBITDA

- OKE’s is 4.5X (4.7X for Fitch).

OKE’s leverage pre-deal is 3.7X; next year, it was expected to be 3.8X.

In other words, OKE has some of the lowest leverage in the industry, and that’s exactly what gives it the financial ability to nearly double its debt and significantly increase its interest costs without risking its BBB stable credit rating.

Fitch Moody’s

ONEOK is becoming a better company after buying MMP, whose refined products pipeline network is one of America’s midstream crown jewels.

Why ONEOK Buying Magellan Is A Good Deal For OKE

I estimate MMP is worth $68.90, and OKE offered $67.5 (factoring in the dilution), which is basically fair value.

It’s better to buy a wonderful company at a fair price, than a fair company at a wonderful price.” – Warren Buffett.

With OKE’s reduced share price, it’s buying $69 in value for $63.65.

Magellan is a 98% quality 13/13 Ultra SWAN, and a 5% discount makes it a potentially good buy.

And OKE is now buying it at an 8% discount. But it’s actually potentially 46%, as I’ll explain in a few minutes.

So OKE is getting a good deal, which is why MMP agreed to the deal.

S&P Likes The Deal

We view the proposed acquisition of Magellan as supportive of the company’s long-term credit quality because it will improve its scale and diversity, which will offset the rise in its leverage…

We also expect the acquisition will improve the company’s geographic diversity and reduce the concentration of its cash flows from the Bakken region. Both businesses have strong fee-based cash flows, thus we expect more than 85% of OKE’s pro forma cash flows will be fee-based.” – S&P.

Fitch Is Neutral On The Deal

Business risk is expected to increase modestly, given MMP’s higher relative contribution from commodity-price exposed operations, largely from MMP’s butane blending franchise. OKE generates roughly 90% of its revenue from fixed-fee arrangements versus approximately 75% at MMP…

Fitch considers the diversification benefits, as well as increased scale and potential small synergistic opportunities to be offset by higher expected leverage and modestly higher business risk, which collectively lead to Fitch’s estimation that this transaction is neutral for OKE’s credit profile. ” – Fitch.

Magellan uses hedges to minimize commodity risk, but Fitch points out that OKE’s cash flows will become slightly more volatile in the future.

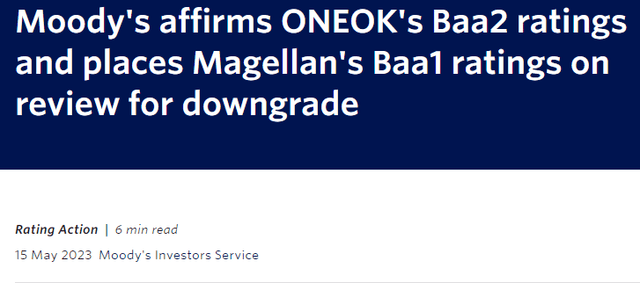

Moody’s Likes The Deal

The acquisition of Magellan’s vast refined products network will broaden and reinforce ONEOK’s business model, boost its scale and diversification, reduce volatility in earnings, and deliver improved returns and profitability through optimization.

The use of significant equity funding and ONEOK’s focus on post-acquisition debt reduction will maintain its solid leverage profile”, said Elena Nadtotchi, Senior Vice President at Moody’s.” – Moody’s.

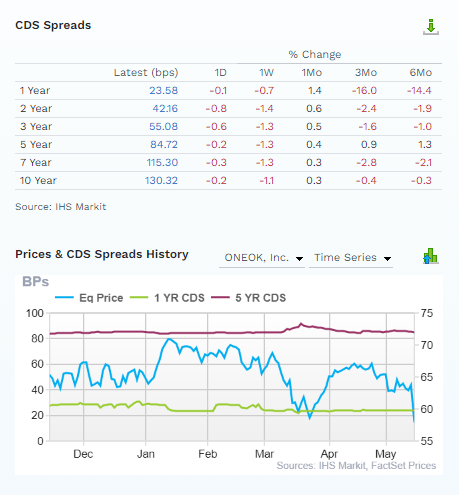

Bond Investors Like The Deal

FactSet Research Terminal

OKE’s price crashed by 10%, and bond investors said…the risk of bankruptcy went down slightly.

This is what I mean when I say we have the “bond market providing real-time fundamental risk assessment.”

In fact, the bond market estimates a 4.9% 30-year bankruptcy risk implying a BBB+ stable credit rating.

- The bond market is predicting an eventual upgrade to OKE’s BBB credit rating.

When news breaks, and share prices crash, we turn to the smart money on Wall Street to let us know if investors should be concerned.

In this case, rating agencies, the analyst consensus, management, and the bond market all say OKE investors can sleep well.

Ultra well, in fact.

ONEOK Upgraded To 13/13 Ultra SWAN

Dividend Safety

| Rating | Dividend Kings Safety Score (250 Point Safety Model) | Approximate Dividend Cut Risk (Average Recession) | Approximate Dividend Cut Risk In Pandemic Level Recession |

| 1 – unsafe | 0% to 20% | over 4% | 16+% |

| 2- below average | 21% to 40% | over 2% | 8% to 16% |

| 3 – average | 41% to 60% | 2% | 4% to 8% |

| 4 – safe | 61% to 80% | 1% | 2% to 4% |

| 5- very safe | 81% to 100% | 0.5% | 1% to 2% |

| OKE | 99% | 0.50% | 1.05% |

| Risk Rating | Very Low-Risk 89th percentile risk management | BBB Stable outlook credit rating =7.5% 30-year bankruptcy risk | 20% or less max risk cap |

Overall Quality

| OKE | Final Score | Rating |

| Safety | 99% | 5/5 very safe |

| Business Model | 80% | 3/3 wide moat |

| Dependability | 99% | 5/5 very dependable |

| Total | 93% | 13/13 Ultra SWAN |

| Risk Rating |

5/5 Very Low Risk |

|

| 20% OR LESS Max Risk Cap Rec |

5% Margin of Safety For A Potentially Good Buy |

OKE was already one of the highest quality and safest midstreams, and MMP’s crown jewel assets and improved diversification mean that OKE has become slightly safer and higher quality.

Why Investors Should Love This Deal

Magellan investors will benefit from far better long-term risk management, according to S&P.

S&P Global Long-Term Risk Management Ratings

| Company |

Long-Term Risk Management Consensus Industry Percentile |

| Williams Companies | 100% |

| Enbridge | 96% |

| ONEOK | 89% |

| TC Energy | 85% |

| Brookfield Infrastructure Partners (Uses K1 Tax Form) | 77% |

| Brookfield Infrastructure Corp | 77% |

| Enterprise Products Partners (uses K-1 tax form) | 70% |

| Pembina Pipeline Corp | 70% |

| Keyera | 56% |

| NextEra Energy Partners | 54% |

| MPLX (uses K-1) | 47% |

| National Fuel Gas | 26% |

| Magellan Midstream Partners (uses K-1) | 13% |

| Average | 66% |

DK uses S&P Global’s global long-term risk-management ratings for our risk rating.

- S&P has spent over 20 years perfecting their risk model

- which is based on over 30 major risk categories, over 130 subcategories, and 1,000 individual metrics

- 50% of metrics are industry specific

- this risk rating has been included in every credit rating for decades.

The DK risk rating is based on the global percentile of a company’s risk management compared to 8,000 S&P-rated companies covering 90% of the world’s market cap.

OKE scores 89th Percentile On Global Long-Term Risk Management

S&P’s risk management scores factor in things like:

- supply chain management

- crisis management

- cyber-security

- privacy protection

- efficiency

- R&D efficiency

- innovation management

- labor relations

- talent retention

- worker training/skills improvement

- occupational health & safety

- customer relationship management

- business ethics

- climate strategy adaptation

- sustainable agricultural practices

- corporate governance

- brand management

- interest rate risk management.

Magellan’s long-term risk management is the weakest in the industry, with management’s plans for a long-term green energy transition lagging every other blue-chip.

MMP’s green energy plans are primarily focused on biofuels like biodiesel and ethanol.

OKE’s plans are focused on hydrogen, renewable natural gas, and carbon sequestration.

MMP’s cash flow stability plans can be summarized as follows:

The U.S. government believes that the EV transition will be slow, and in our market, the Midwest, we expect refined product demand to remain stable through 2050.

Rating agencies don’t necessarily disagree, and the bond market is willing to buy MMP’s bonds that mature in 2050, implying the smart money on Wall Street also agrees.

However, the point is that OKE is an industry leader in planning for the day when oil & gas play a minor role in transportation and when the primary role of oil and gas is in petrochemicals, not fuel.

- MMP was dragging its feet on the green energy transition

- OKE is leading the charge.

OKE’s Long-Term Risk Management Is The 95th Best In The Master List 81st Percentile In The Master List)

| Classification | S&P LT Risk-Management Global Percentile |

Risk-Management Interpretation |

Risk-Management Rating |

| BTI, ILMN, SIEGY, SPGI, WM, CI, CSCO, WMB, SAP, CL | 100 | Exceptional (Top 80 companies in the world) | Very Low Risk |

| ONEOK | 89 |

Very Good, Bordering On Exceptional |

Very Low Risk |

| Strong ESG Stocks | 86 |

Very Good |

Very Low Risk |

| Foreign Dividend Stocks | 77 |

Good, Bordering On Very Good |

Low Risk |

| Ultra SWANs | 74 | Good | Low Risk |

| Dividend Aristocrats | 67 | Above-Average (Bordering On Good) | Low Risk |

| Low Volatility Stocks | 65 | Above-Average | Low Risk |

| Master List average | 61 | Above-Average | Low Risk |

| Dividend Kings | 60 | Above-Average | Low Risk |

| Hyper-Growth stocks | 59 | Average, Bordering On Above-Average | Medium Risk |

| Dividend Champions | 55 | Average | Medium Risk |

| Monthly Dividend Stocks | 41 | Average | Medium Risk |

(Source: DK Research Terminal.)

OKE’s risk-management consensus is in the top 11% of the world’s best blue chips and is similar to:

- 3M (MMM): Ultra SWAN dividend king

- BlackRock (BLK): Ultra SWAN

- Royal Bank of Canada (RY): Ultra SWAN

- Intuit (INTU): Ultra SWAN

- Northrup Grumman (NOC): Ultra SWAN.

The bottom line is that all companies have risks, and OKE is very good, bordering on exceptional, at managing theirs, according to S&P.

How We Monitor OKE’s Risk Profile

- 23 analysts

- three credit rating agencies

- 26 experts who collectively know this business better than anyone other than management

- the bond market for real-time fundamental risk assessment.

What Does The New OKE Mean For Dividend Investors?

- OKE’s distributable cash flow is $3.4 billion

- MMP’s distributable cash flow is $1.2 billion

- new OKE: $4.6 billion.

For context, ENB is the industry titan with $8.25 billion in distributable cash flow, and OKE will now be approximately half as large.

MMP was expected to grow 5.9% over time, and OKE slightly faster.

Long-Term Consensus Total Return Potential

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return |

| Magellan Midstream (K1 tax form) | 6.7% | 5.9% | 12.6% | 8.8% |

| ONEOK | 6.6% | 6.8% | 13.4% | 9.4% |

| REITs | 3.9% | 7.0% | 10.9% | 7.6% |

| Schwab US Dividend Equity ETF | 3.6% | 7.6% | 11.2% | 7.8% |

| Dividend Champions | 2.6% | 8.1% | 10.7% | 7.5% |

| 60/40 Retirement Portfolio | 2.1% | 5.1% | 7.2% | 5.0% |

| Vanguard Dividend Appreciation ETF | 2.0% | 11.3% | 13.2% | 9.3% |

| Dividend Aristocrats | 1.9% | 8.5% | 10.4% | 7.3% |

| S&P 500 | 1.7% | 8.5% | 10.2% | 7.1% |

| Nasdaq | 0.8% | 11.2% | 12.0% | 8.4% |

(Sources: DK Research Terminal, FactSet, Morningstar.)

OKE and MMP’s yields have now converted, and their growth rates are similar, with OKE expected to deliver slightly better long-term returns.

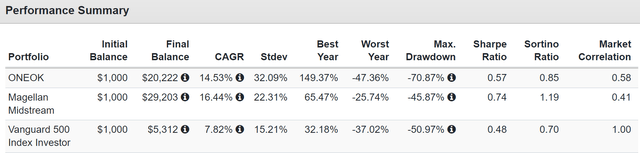

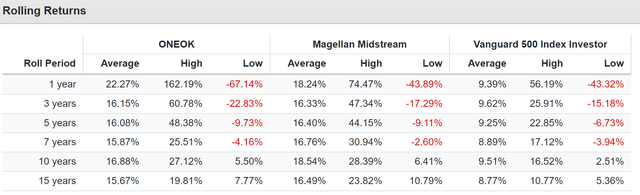

Total Returns Since 2001

Portfolio Visualizer Premium

Historically OKE and MMP have similar returns though OKE has been a far more volatile stock.

Portfolio Visualizer Premium

Both are proven market-beaters.

What about OKE’s dividend safety? Should income investors be worried that MMP has a 21-year payout growth streak while OKE’s dividend growth streak is just one year?

Not at all. OKE hasn’t cut its dividend since 1989, 34 years without a cut.

- through five recessions

- seven bear markets

- two economic crises

- three major oil crashes

- including the worst oil crash in human history, -$38 crude.

What about the payout ratio? We’ve seen how OKE’s leverage is going to jump to 4.3, a safe level, but what about the effects on the payout ratio after all those new shares are issued?

- OKE’s pre-deal payout ratio is 55% vs. 83% safe.

Here’s the new payout ratio post-MMP acquisition.

- New share count: 587 million

- OKE’s distributable cash flow is $3.4 billion

- MMP’s distributable cash flow is $1.2 billion

- new OKE: $4.6 billion

- new DCF/share: $7.84 vs. $3.82 dividend

- new payout ratio: 49%.

What about free cash flow payout ratios?

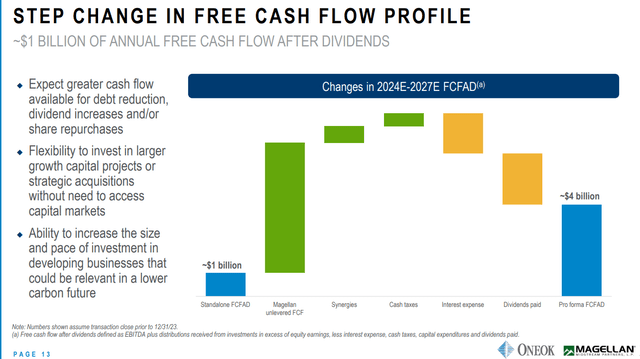

investor presentation

OKE today generates $1 billion in annual free cash flow.

- $1.7 billion annual dividend

- not FCF self-funding like MMP

- 170% FCF payout ratio.

The new OKE will now generate $4 billion in free cash flow and pay $2.25 billion in dividends.

- 56% free cash flow payout ratio (49% DCF payout ratio)

- fully FCF self-funding

- Zero reliance on debt or equity financing for organic growth.

This deal is fantastic for OKE investors because they now have one of the safest dividends in the industry, and OKE will now have $1.75 billion in post-dividend retained cash flow to pay down debt, invest in its business, make small acquisitions, or buy back shares.

For context, the market cap of the new OKE is $34 billion, and if management wanted to use all its retained cash flow for buybacks, it could repurchase 5.1% of its stock each year.

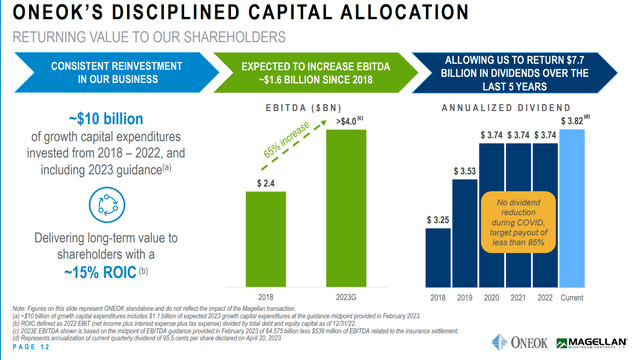

OKE’s consensus long-term cash flow growth is 6.8% annually.

In other words, through buybacks alone, OKE has some of the best growth prospects in the industry.

MMP investors benefit from the following:

- A much lower payout ratio as well (78% FCF payout ratio)

- much higher retained free cash flow than MMP was generating

- about 2X the share buyback potential.

The New ONEOK Is A Midstream Titan

Who is ONEOK? It was founded in 1906 and is one of the oldest midstreams in the world. Its corporate culture is built on long-term durability, and it’s survived and thrived through:

- 19 recessions

- four depressions

- a flu pandemic that killed 5% of humanity

- two world wars

- inflation as high as 22%

- interest rates as high as 20%

- over 23 bear markets

- 78 market corrections

- 234 market pullbacks

- dozens of oil crashes

- including oil hitting $-38 in April 2020.

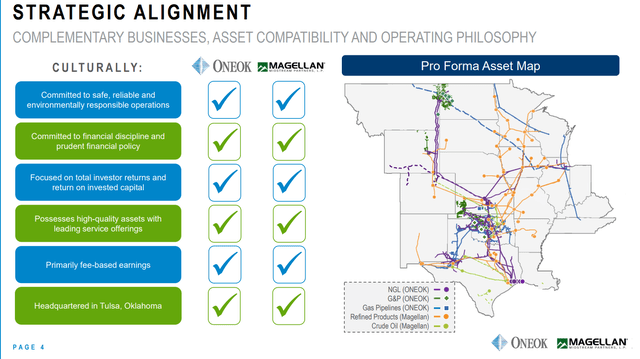

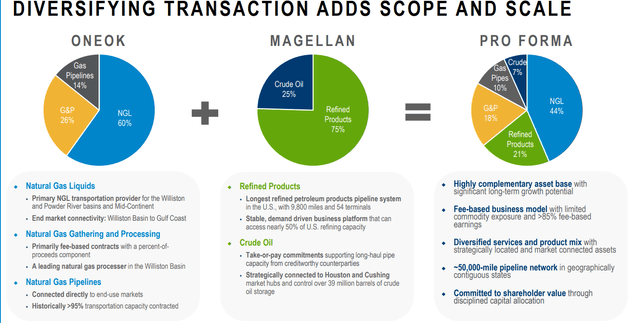

investor presentation

The new OKE is much more diversified, which is what rating agencies like.

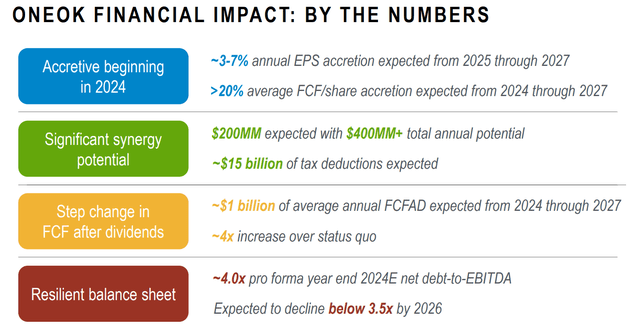

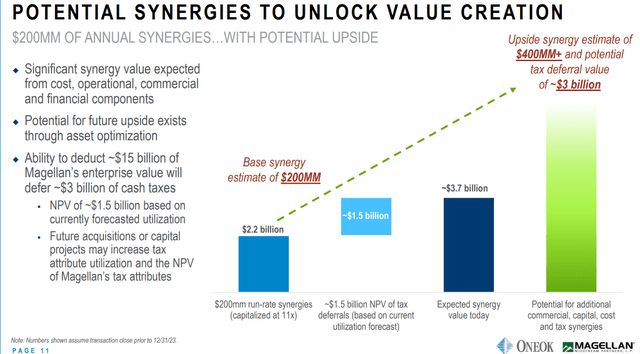

OKE management believes that thanks to $200 million in cost synergies, it will be able to grow about 5% faster from 2025 through 2027 after buying MMP.

investor presentation

OKE is also getting $15 billion in tax deductions from MMP’s MLP status.

Free cash flow is going to soar after this deal, and management plans to bring down leverage to 3.5X by 2026.

- The BBB+ upgrade the bond market is already pricing in.

investor presentation

The new OKE will be a mini-Enterprise Products Partners L.P. (EPD), a vertically integrated midstream giant taking contracted fees from well to end user at every supply chain step.

Its primary business will now be natural gas liquids, with a very stable secondary business of refined products.

investor presentation

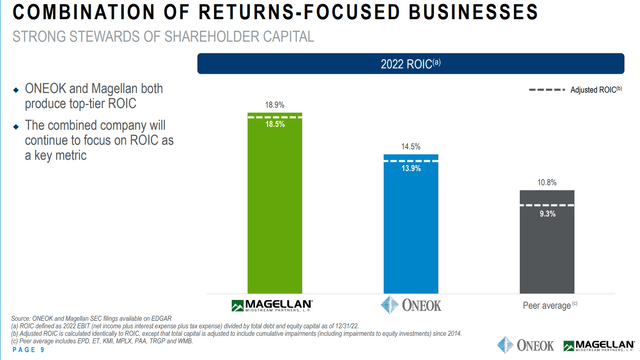

The new OKE’s returns on invested capital will be 15.5%, nearly 50% more than its average peer.

investor presentation

OKE believes the synergistic cost savings could be enormous. $3.7 billion discounted to today’s value plus an additional $3.4 billion potential savings later

- $7.1 billion in total potential synergistic cost savings

- 38% of the purchase price

- 46% potential effective discount to fair value for MMP.

investor presentation

OKE is one of the best-run midstreams in America and the most dependable in terms of dividend safety.

investor presentation

Management is on track to achieve a BBB+ credit rating upgrade, and if it continues to reduce leverage to 3X, rating agencies will upgrade it to A- just like EPD.

Bottom Line: Morningstar is Right. This is a great deal for both MMP and OKE investors.

What Investors Should Do Now: Sell MMP And Buy OKE

Bottom line up front.

- Magellan is an MLP and uses a K-1 tax form

- 5 Things All MLP Investors Need To Know

- typical foreign investors have a 37% withholding (whether they can recoup it depends on their country’s tax code).

Sometimes when a major acquisition is announced, arbitrage opportunities become available for long-term investors to buy the company being acquired to get discounted shares of the acquirer.

This opportunity was arbitraged away on the day the deal was announced.

- The 0.667 shares of OKE are now worth $38.65

- plus $25 cash = $63.65 implied value of MMP units

- MMP price $62.61

- Arbitrage opportunity 1.6% gain.

Before the deal was announced, MMP buyers would have gotten an implied value of $67.5, and there was an arbitrage opportunity of 7.6%.

In other words, buying MMP instead of OKE could have netted you 7.6% cheaper OKE shares or a 7.6% short-term profit.

That arbitrage opportunity has been reduced by 79%, implying that the market believes there is an approximate 80% chance this deal will go through.

- Regulators need to approve it.

If you buy MMP today, the upside is minimal, 1.6%. And if regulators block the deal, MMP will likely give back its 13% gain on May 15th.

- The downside risk is 8.2X the upside potential.

In other words, buy OKE today rather than MMP.

Should you sell Magellan and buy OKE? I think that’s prudent, and here’s why.

There is very limited upside left for MMP if you wait for the deal to close.

In the 19% chance the deal falls apart, OKE would likely rebound 10%, and MMP would likely give back its 13% gains.

OKE is a slightly faster-growing company, and that’s before the benefits of this deal are taken into account.

- management believes the growth rate might improve by 20% long-term

- to 8.2% based on current consensus, growth forecasts

- potentially 14.8% long-term returns.

What about tax implications? Long-term investors in MMP will face significant tax liabilities.

- long-term cap gains taxes on their deferred distributions up to their cost basis (if you’ve owned it long enough)

- UBTI taxes (from depreciation recapture).

How much of a tax bill are MMP investors facing?

It will be different for everyone, depending on how long you’ve owned it.

The next (and last) K1 tax form from MMP will be out in March 2024 and will show your tax liability.

The tax bill will be very similar whether you sell MMP today or wait until the deal closes in a few months.

- MMP would pay one or two distributions at most.

So with no significant changes in your tax liabilities and OKE now a much safer, stronger, and faster-growing company, it’s reasonable and prudent to sell MMP and buy OKE.

OKE Summary:

- DK rating: 93% quality, very low risk 13/13 Ultra SWAN midstream corporation (no K1)

- safety rating: 99% very safe (1.05% risk of a cut in severe recession)

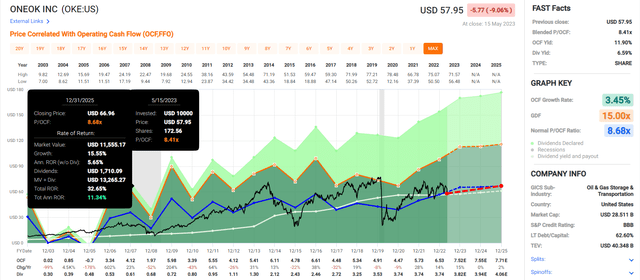

- Fair Value: $65.22

- current price: $57.95

- Discount: 11%

- DK rating: potential good buy

- Yield: 6.6%

- growth consensus: 6.8%

- Long-term return potential: 13.4% (and possibly 14.8%).

FAST Graphs, FactSet

Note that management is guiding for a 20% boost to cash flow through 2025 from this deal.

- 38% total return potential through 2025

- 13.6% annually through 2025

- 13.3% annually through 2029

- 13.4% annually long-term.

Bottom Line: ONEOK Buying Magellan Is A Big Win For High-Yield Income Investors

OKE buying MMP is one of the best-structured midstream acquisitions I’ve ever seen.

OKE offered to buy Magellan at fair value and is now likely to buy it for a modest 8% discount, a good deal for the assets it’s buying.

What’s more, the potential synergistic cost and tax savings are $7 billion, meaning that OKE is potentially buying MMP at a 46% discount.

That’s a deal only available in the Pandemic crash.

- $12 billion potential final purchase price

- 7.3X potential EV/EBITDA.

OKE is buying the most profitable assets in the industry, with some of the most stable cash flows, at a Shark Tank multiple that makes private equity deals look expensive.

Management believes this incredible potential valuation could boost OKE’s long-term growth rate by 20% to an industry-leading 8.2%.

But don’t think MMP investors aren’t getting a great deal as well.

Yes, there will be tax liabilities, which will vary for each investor depending on how long you owned MMP.

But you’re now getting a much safer dividend, with a 56% free cash flow payout ratio (down from 78%) and $1.75 billion in annual post-dividend retained free cash flow.

The new OKE will have the potential to buyback shares twice as fast as MMP, up to 5% per year.

The leverage ratio by 2026 will be 10% lower than Magellan investors currently enjoy.

And the bond market is expecting S&P to upgrade OKE to BBB+ within a few years.

In fact, with OKE’s new free cash flow self-funding model, the leverage ratio might continue to fall long beyond 2026, and OKE could eventually join EPD as an A-rated midstream.

OKE is the most battle-tested midstream blue-chip of all. It’s 117 years old and has survived depressions, world wars, killer pandemics (7 of them), and the worst oil crashes in history.

It hasn’t cut its dividend in 34 years, and even if we get a severe recession, its risk of a cut is approximately 1.05%.

Given the current facts, I recommend selling Magellan since the tax implications are nearly identical to holding until the deal closes and buying OKE.

In the 19% probability that the deal isn’t approved, OKE investors will likely enjoy a double-digit rebound, while MMP’s price would likely give back its 13% rally.

I’m very pleased with this deal as someone who owns $1,200 of OKE via ETFs.

And I applaud management at both ONEOK, Inc. and Magellan Midstream Partners, L.P. for putting together a wonderfully fair and beneficial deal for all investors involved.

Read the full article here