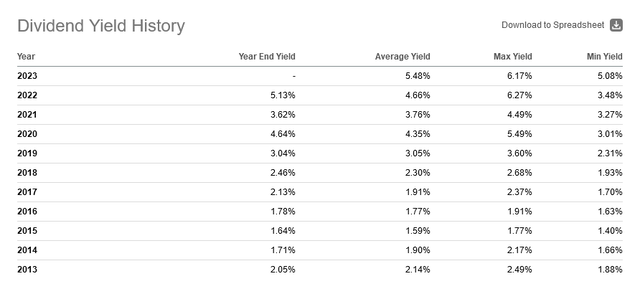

Walgreens Boots Alliance (NASDAQ:WBA) is now offering one of the highest dividends yields in its history. The forward dividend yield is 6.12% today compared to an all-time high of 6.27%. This is far higher than the average over the last 10 years. This dividend is either a major attraction or a huge red flag. It’s as if investors have left this one for dead.

Seeking Alpha Seeking Alpha

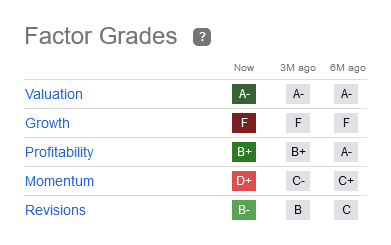

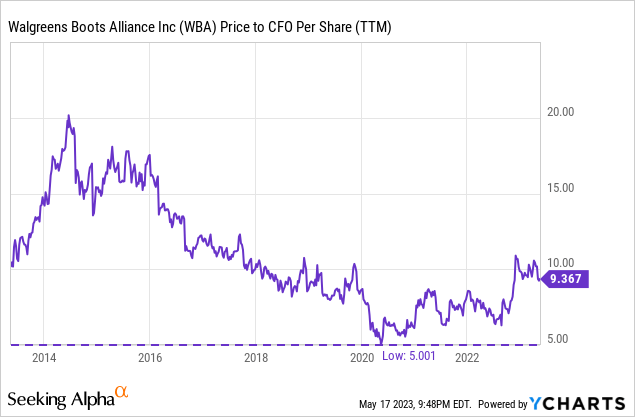

The overview of the company is mixed. On the positive side is valuation and profitability. WBA earns an operating cash flow yield of 13.09% with net income per share of $0.81 during the last quarter. The dividend is currently covered with a 47% payout ratio. The issue is growth, which has been negative overall for a few years.

Seeking Alpha

WBA is in the process of re-imagining its overall brand by expanding into healthcare services. If successful, the future may be rescued for this turnaround candidate. We’re interested by the possibilities and gave WBA a position in our portfolio.

Healthcare to Save the Company On Life Support

WBA is suffering from secular headwinds in its retail business segment. The U.S. retail pharmacy segment experienced a 1.3% decline in revenue YoY. During the same span, segment operating income declined by 14.4%. This segment is currently responsible for 79% of total revenue. The company is struggling with rising labor costs and staffing inconsistency. Margins for pharmaceuticals is under pressure as prices fall and competition rises, particularly competition from mail order pharmacies.

Long term, the demand for pharmaceuticals is expected to be strong. Between 2021 and 2028, the U.S. pharmacy market size is expected to grow at a CAGR of 6.3%. This alone won’t be enough to secure market share for WBA. Management has decided to invest in a different future with vertical integration of healthcare services for its patients.

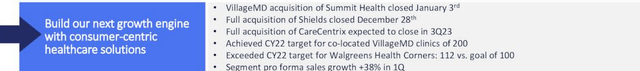

WBA has been busy with acquisitions of health service providers. In the last year, WBA has partnered with or acquired stake in VillageMD, Summit Health and Shields. The acquisition of CareCentrix is expected to complete later this year. In total there are 729 care locations.

Seeking Alpha (company presentation)

Management’s objective is to take advantage of synergies through a vertical integration model. Walgreens will be able to have control over quality assurance and costs through each stage of healthcare services that it offers and establish brand loyalty. Ideally, the result would be a more convenient process of obtaining care which is a widely appreciated feature that many patients struggle with.

The graphic below demonstrates how each business branch is contributing to the integration process. The traditional retail stores will continue to offer pharmaceutical services. Locations with Health Corners will be able to expand services to include pre-acute care. VillageMD and Summit Health will cover primary care while Shields and Alliance Rx contribute to specialty care services. Finally, CareCentrix will offer post-acute care services.

Seeking Alpha (company presentation)

Last year, healthcare services accounted for 12% of company revenues. Pro forma sales growth for U.S. healthcare was 30% YoY in Q2 2023. The segment is not yet profitable with a quarterly operating income loss of $159 million. Operating margin for the US Healthcare segment has improved from -40.2% to -28.9%.

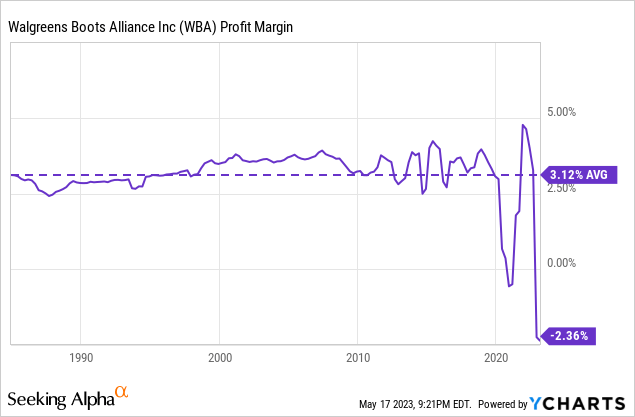

With the profit margin teetering back and forth across the zero bound it should rightly make investors uncomfortable. The margin has most recently turned negative due to a $6.5 billion pre-tax charge related to opioid litigation and claims. For most of its history, the company has maintained consistent net margins with an average of 3.12%. Since the start of the pandemic, margins have swung wildly when shutdowns first drove away traffic then vaccines drove traffic back. We expect that in the quarters ahead the margin will stabilize and return to near its long term average.

The inevitable slowdown in COVID-19 related pharmaceutical services is impacting the company’s top-line. Nonetheless, management expects full year core sales growth to be 8% to 10%.

Valuation and Price Targets

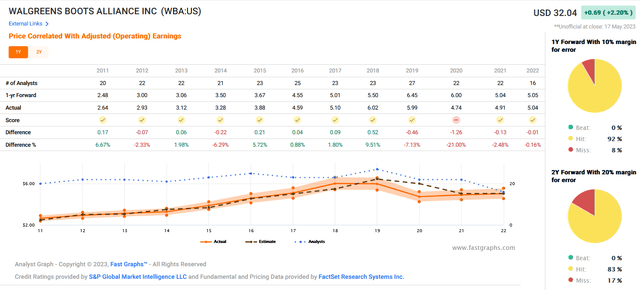

Notably, analysts have a solid track record of estimating company earnings. Over 1 and 2 year time periods analysts have an 83%+ rate of accurately forecasting the adjusted operating earnings for WBA.

FAST Graphs

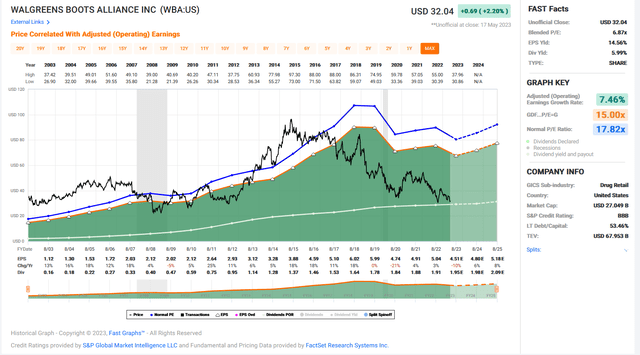

Analysts are expecting a decline of 10% in adjusted earnings for 2023 followed by increases of 6% and 8% in 2024 and 2025. This results in a current adjusted earnings yield of 14.5%. WBA has been widely criticized for the recent years of share price under-performance. Over the past 10 years, the stock has experienced a compound growth rate of -8.26% compared to the S&P 500 of 11.87%. Much of this is due to a massive valuation re-rating. The company was arguably overvalued in 2015 when it traded at 25x adjusted earnings and 1x sales. Today, it trades at 6.87x adjusted earnings and 0.2x sales. Since 2015, adjusted earnings are 16% higher and sales are 56% higher.

FAST Graphs

We have established a long position in WBA and will add to our position on weakness. We are selling covered calls to hedge our position. When we anticipate share strength, such as now, we are selling 1-2 week calls at 3-5% out of the money. The May 26, 2023 $33.50 call is offering a 3.8% annualized yield. After strong share performance we will consider a longer term call to provide downside protection. An example of this is the October 20, 2023 $35 call which offers an annualized yield of 7.6% with 3.2% downside protection, and 9.3% upside potential in addition to the dividend.

Summary

Walgreens is a large retailer with expansive reach. About 75% of Americans live within 5 miles of a Walgreens location. Walgreens has the scope necessary to achieve economies of scale and cost efficiencies to maintain its market share. The question of growth will likely depend on the success of their vertical integration plan in the Healthcare segment.

The dividend appears safe and is generous for investors if maintained. We do not yet see a reason why it would not be maintained. The company has a 30 year consecutive track record of dividend growth. There will likely continue to be more growing pains as the integration of the healthcare segment improves. We are optimistic about its future and ability to allow WBA to achieve modest, single digit earnings growth in the years ahead.

Read the full article here