Strategic Education, Inc. (NASDAQ:STRA) is a small-cap stock providing adult students with higher education. It has rewarded investors with 28.82% in returns over the last year. The company has beat EPS expectations in its most recent earnings report. It has also declared a dividend of $0.60 per share (ex-div 25 May). However, earnings have been decreasing YoY, and cash flow has been downward trending, which makes us cautious of the company’s ability to maintain this dividend.

One-year stock trend (Seeking Alpha)

According to research, the educational market is recovering, with technological advancements playing a significant role. However, the results for Strategic Education were flat if we look at the top-line growth in Q1 2023. Its Australian and New Zealand markets negatively impacted its diversified portfolio of educational segments, including attractive margined subscription-based technology models, strong partnerships with USA colleges and universities, and international institutions. However, the company expects a better performance for the latter part of the year due to the full return of international students for the first time since 2020 in Australia and New Zealand. I recommend a hold position while we wait for the top-line growth to improve.

Introduction

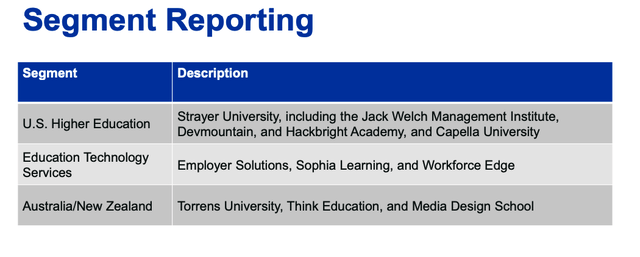

Strategic Education provides higher education, college and occupational degrees for adult students on a part-time basis. It is compelling because it gives adults access to affordable, industry-relevant training, certificate, and degree programs. Below we can see how the company generates revenue broken up into its three segments.

Segment reporting (Investor presentation 2023)

One of the compelling growth factors for the company this year has been its US Higher Education segment has grown for the first time since 2020. It increased YoY in Q1 2023 by 2.3% due to increased enrollments in the Capella and Strayer University programs, with an addition of growth from employer-affiliated registration. The company has a subscription-based offering, Sophia Learning, which gives students access to over 50 college-level courses for $99 per month. It has recently partnered with the University of the People, which gives them access to a potential 126,000 students. Credits can be transferred to partner colleges and universities. This program has been very successful; total subscribers grew by 24% YoY in Q1 2023, with revenue increasing by 36%.

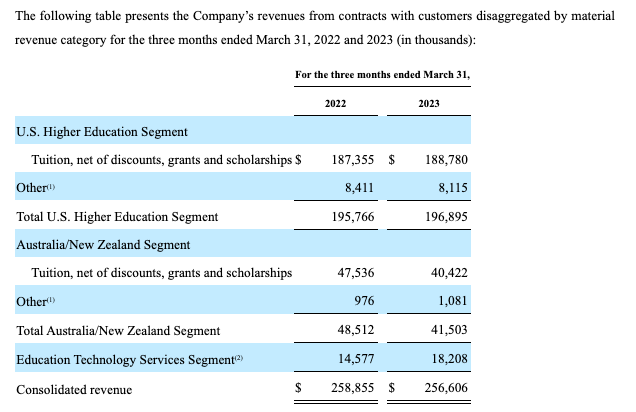

Q1 2023 vs Q1 2022 (sec.gov)

Although we can see 2023 indicates that education is rebounding, the company did not see significant growth due to structural educational changes in its international markets and the continued lack of international students able to partake in these courses due to visa restrictions in New Zealand and Australia, which could continue into the rest of the year. However, in the second half of the year, international student numbers are expected to fully recover to 2020, which could positively impact the company’s enrolment and revenue performance.

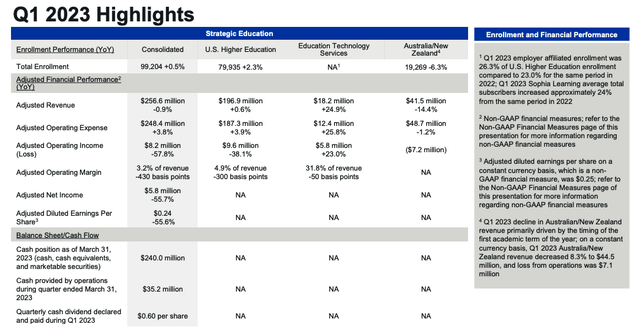

Q1 2023 highlights

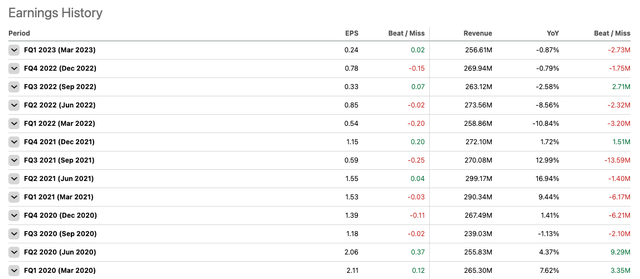

Strategic Education beat EPS expectations in its most recent Q1 2023 Earnings report by $0.02 to reach an EPS of $0.24. However, as we can see in the history below, earnings have decreased YoY from $0.54 per share in Q1 2022.

Quarterly earnings history (Seeking Alpha)

The company experienced growth and increased revenue in its educational technology and US Higher Education segments. Unfortunately, revenue decreased by 6.3% compared to the previous year in Australia and New Zealand, which had a negative impact on the overall revenue growth.

Q1 2023 Highlights (Investor presentation 2023)

The company has a TTM positive free levered cash flow of $55.32 million. While it is good to see that the company is positive, we can see that cash flow has been downward trending over the last three financial years, and quarterly cash flow is inconsistent. The company pays out a dividend with an ex-div date of May 25, which will be paid on June 5 at a forward yield of 2.6% at $0.60 per share. Although this is attractive, its annual payout ratio is 109.09%, which is unsustainable. If we look at the balance sheet, we can see that the company has total cash of $227.31 million and has been reducing its debt to $256.26 million. The company is liquid, with a current ratio of 1.48 and a quick ratio of 1.24.

Valuation

STRA stock is currently trading well below its average target price of $102.67. Although the stock value increased over the last year by 28.82% we can see that over the last month the stock has been downward trending by 13.89% and there is a short interest of 6.35% which underperformed the S&P index as shown below.

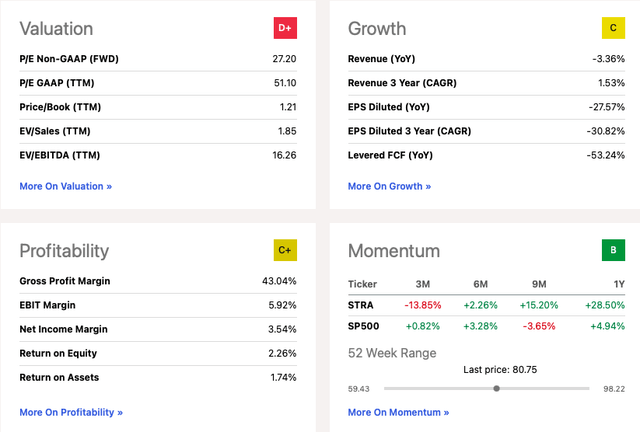

Quant Rating (Seeking Alpha)

The stock’s FWD price-to-earnings ratio of 27.20 is above the consumer discretionary median of 12.27, indicating that the stock may be overvalued and the growth YoY has been negative on the top and bottom lines. However, one of the standouts for this stock is its high gross profit margin of 43.04% which is influenced by some of its high-margin subscription-based solutions.

Risks

Strategic Education is a global organization that is influenced by geopolitical factors such as visa regulations that affect the number of students able to attend courses in the markets of New Zealand and Australia. The pandemic has had a significant impact on the company’s operations. Additionally, the organization heavily depends on partnerships with universities and colleges for enrollment growth. Any changes to these partnerships can swiftly result in negative effects on growth, as observed in the markets of Australia and New Zealand.

Final thoughts

Strategic Education is experiencing positive momentum in its USA and educational technology services segments. The management predicts mid-single-digit growth in revenue for FY2023. Additionally, they anticipate that the Australian and New Zealand market will recover to 2020’s international student numbers in the latter half of the year. The stock’s value declining over the past month and is trading well below its average target price. I believe the next quarter will better indicate whether its international markets will recover, potential growth from its new University of the People partnership and therefore recommend a wait-and-see hold position.

Read the full article here