On our last coverage of Oxford Lane Capital Corporation (NASDAQ:OXLC) we suggested that the preferred method of investing here was to go higher up in the capital stack.

In that regard, the newly issued Oxford Lane Capital Corp – 7.125% PRF REDEEM 30/06/2029 (OXLCN) are a great choice and one that would likely outperform OXLC if you consumed the distributions.

Source:

The two (OXLCN and OXLC) went about neck and neck for total returns since then, so it is still too soon to call a winner. We look at the latest NAV data and the distribution hike just announced, to update our outlook.

Results

The results were generally solid, and the NAV stood flat while the company generated a strong net investment income.

Net asset value (“NAV”) per share as of March 31, 2023 stood at $4.61, compared with a NAV per share on December 31, 2022 of $4.63.

Net investment income (“NII”), calculated in accordance with U.S. generally accepted accounting principles (“GAAP”), was approximately $37.4 million, or $0.22 per share, for the quarter ended March 31, 2023.

Our core net investment income (“Core NII”) was approximately $37.5 million, or $0.22 per share, for the quarter ended March 31, 2023.

Source: OXLC

One might wonder why the company deserves credit for a flattish NAV, but that question would only arise if you are just tuning in to the story. NAV has dropped from the inception levels of near $20 per share pretty steadily and now stands at near 25% of original values.

OXLC’s NAV has fallen so much despite share counts going up relentlessly quarter after quarter. Each of those share issuances were done at a premium to NAV and hence accretive to it. This quarter was no different.

For the quarter ended March 31, 2023, we issued a total of approximately 3.9 million shares of common stock pursuant to an “at-the-market” offering. After deducting the sales agent’s commissions and offering expenses, this resulted in net proceeds of approximately $22.6 million. The common stock issuance resulted in net accretion to shareholders of approximately $0.03 per share of NAV for the quarter. As of March 31, 2023, we had approximately 172.1 million shares of common stock outstanding.

Source: OXLC

OXLC did surprise perhaps some as it raised its distribution to 8 cents a month. At 96 cents a year, the yield is now over 20% on NAV. This is likely to get the income chasing crowd excited once again. After all, nothing says distribution sustainability than a constantly falling NAV alongside a higher yield.

Outlook

Leveraged loan defaults are just getting into the “sweet” part of the cycle.

A trio of Chapter 11 filings has propelled the default rate of the Morningstar LSTA US Leveraged Loan Index to a two-year high, and the quarterly annualized default rate to its highest level since the pandemic default peak of September 2020.

Starting with the more commonly cited trailing-12-month calculation, the 1.58% default rate by amount is only 28 bps shy of the 1.86% 10-year average for leveraged loan defaults.

With one issuer rolling off the 12-month trailing calculation, the three defaults (courtesy of Envision Healthcare, Monitronics International and Venator Materials) added 30 bps to May’s starting point of 1.28%. Venator filed on Sunday, May 14, while Envision and Monitronics filed on May 15.

Source: Yahoo Finance

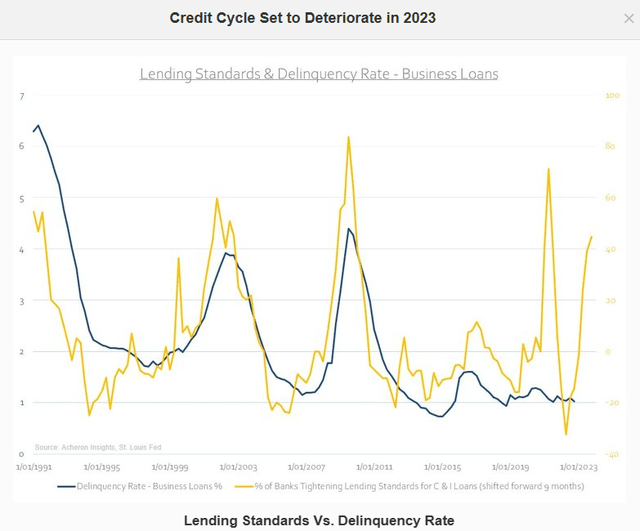

Before investors rush to tell us that this is still low, we can confirm that fact. Our point is that we think this is just the warm-up. The chart below only goes to the start of 2023. So it does not show the default rate pick up, and it does not show that lending standards have tightened far more after regional bank distress. But it should get the message across.

Acheron Insights

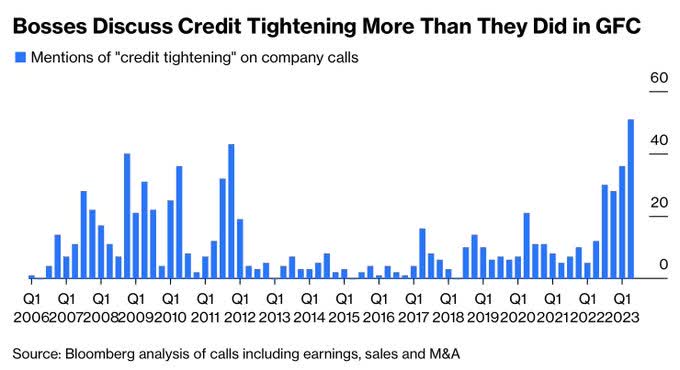

On the Q1-2023 conference calls, tightening was the theme.

Bloomberg

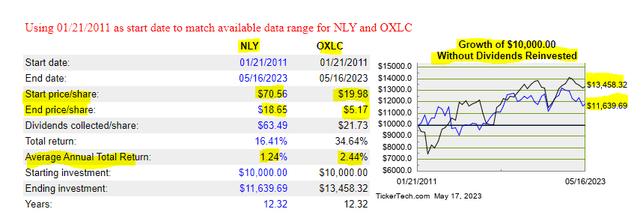

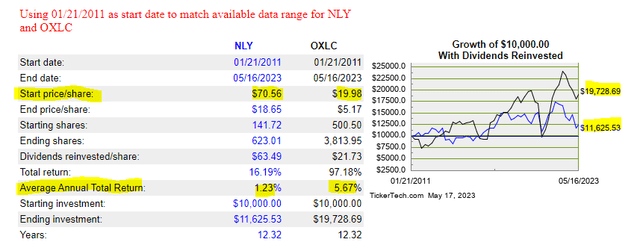

Raising the distribution rate at this stage of the cycle will play out exactly as it should, with regret. In relation to that, we will once again note that those that consume these distributions don’t do very well. Actually they do really badly and their returns don’t compare remotely to the results posted with distributions reinvested. Ticker Tech, a site we use for this, was refusing to compare funds, so we had to settle for a different benchmark. We have shown OXLC data below with another popular yield pick, Annaly Capital Management Inc. (NLY) over the last 12.32 years (since OXLC inception). The good news is that without dividends reinvested, you did twice as well as NLY. The bad news is that you made 2.44% and not the starting yield, which was close to 10% at the fund’s inception.

Ticker Tech

Of course, if you are getting this huge income stream to reinvest it back, then it really makes no sense to ask for a huge payout. You should be indifferent to a 1% yield vs a 10% yield. But even if you did that, your returns are not exactly spectacular.

Ticker Tech

To this, you must add that OXLC is regularly raising capital at 15-20% premiums and likely added anywhere from 1-4% annualized returns because of this accretive capital raising. What would the returns be if this chronically traded below NAV? You might find out in the next exciting episode of this investing saga.

A Switch

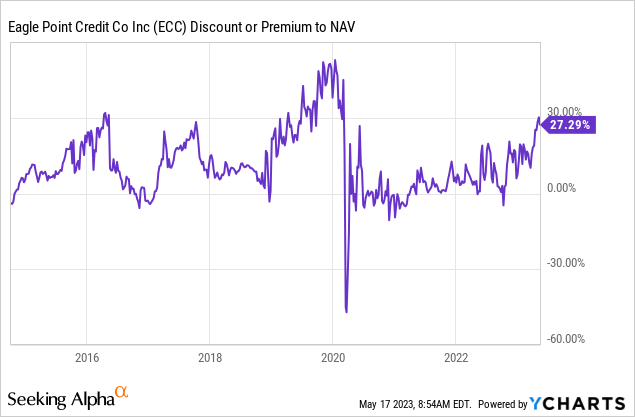

All that said, we are here to still suggest that OXLC may be a relatively better opportunity compared to some weirdness that is happening in the market. The one we are referencing here is Eagle Point Credit Co LLC. (ECC). ECC trades near a 27% premium to its NAV. This level has proven to be a real kryptonite for 12 month out returns as it cycles to a slight discount.

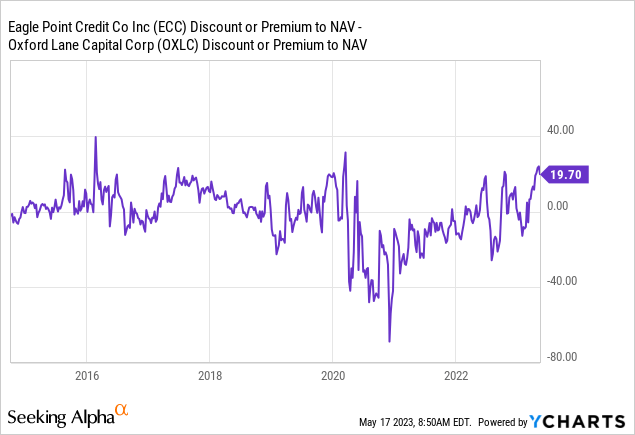

Interestingly, here ECC also trades at huge relative premium when we benchmark against OXLC.

Do note that ECC’s NAV data runs through April, and OXLC’s through March, but considering that ECC’s NAV barely moved from March to April, we think this is good enough to plot.

Verdict

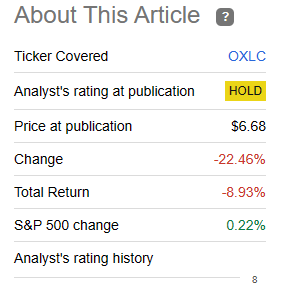

Since our first coverage (See, A Bad Setup For Income Investors), OXLC has had a “meh” performance.

Seeking Alpha

At present, the credit tightening is a far greater headwind than it was one year back. Sure, the CLO payouts have improved, and the floating rates have kicked in to help. New investment yields have also gone up. But on the whole, we don’t see prospects of a great income vehicle here. Now there will be someone who will identify a point from where it has done really well, and there probably are such points for most stocks and funds. We just don’t think this moment in time is one from where you stand to make great returns. After all, those consuming distributions did extremely poorly from the very inception of this fund. We can all agree that most of that period was marked by a Federal Reserve determined to blow bubbles into the fixed income space. With a potential recession up next and a decidedly hostile Federal Reserve, we would stay defensive. If you like OXLC then consider some of its baby bonds or preferred securities. We still like OXLC relative to ECC, but we are not interested in buying either.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here